Planning on taking an extended trip soon? Long-term travel insurance is the perfect choice for travelers who are embarking on a long-term trip and need medical- and travel-related coverage.

Of course, insurance for long-term travel isn’t necessary for every traveler, particularly if you don’t take trips that are longer than three months. However, long-stay travel insurance is useful for anyone who is studying abroad, working abroad temporarily, taking a gap year, or simply traveling for a long period of time.

4 Best Long-Term Travel Insurance in 2024 (w/ Prices)

When I first moved to the US, I wasn’t sure if I would stay permanently, so I purchased a long-term travel insurance policy from Heymondo, knowing that it would save me money and give me coverage if I experienced any medical emergencies. It was exactly what I needed at the time.

As soon as I decided to live in the US permanently, I switched to insurance with more medical coverage beyond emergency situations since extended-trip travel insurance is not suitable for expats who want routine medical care.

If extended-stay travel insurance is what you need, keep reading, because we have compared the best long-term travel insurance plans (Heymondo, World Nomads, Travelex, and SafetyWing) and can help you choose which of these is best for your trip.

- What is long-term travel insurance?

- Long-stay travel insurance coverage comparison

- Long-stay travel insurance price comparison

- Best long-term travel insurance companies

What is long-term travel insurance?

Long-term travel insurance is insurance for anyone taking a long-term trip who needs medical expenses and trip-related coverage. Any trip that lasts a minimum of 90 days and a maximum of one or two years (depending on the long stay travel insurance company) is considered a long-term trip.

What is long-term travel insurance?

Like other travel insurance, insurance for long-term travel provides medical- and travel-related coverage for incidents like emergency medical care, trip delays, baggage loss, and repatriation. It is not suitable, however, for anyone who is permanently living abroad, especially because it only covers emergency medical expenses and not routine medical care.

Long-term travel insurance vs. annual, multi-trip travel insurance

So, is long-trip travel insurance the same thing as annual, multi-trip travel insurance? They might sound similar, but actually, insurance for long-term travel and annual travel insurance is completely different.

Long-term travel insurance vs. annual, multi-trip travel insurance

Long-term travel insurance is insurance for long trips that last three months or more, while annual travel insurance covers multiple shorter trips that happen within one year. With annual travel insurance, trips are restricted to 30-90 days, so it’s not a useful option if your trip will last any longer than that. Annual travel insurance is also only helpful if you’ll be taking at least four or more trips a year.

If you are going on a single, long-term trip or are taking multiple trips within a year that will last longer than 90 days, long-stay travel insurance is the best choice for you.

Who is insurance for long-term travel for?

There are several reasons you might need insurance for long-term travel. You might be taking an extended trip, working abroad, embarking on a gap year, or more. Below are the most common and useful reasons for buying travel insurance for long-term travel:

Long-stay travel insurance coverage comparison

There can be many considerations to keep in mind when purchasing long-term travel insurance, but coverage is certainly the most important aspect to consider when selecting the long-stay travel insurance you want to buy.

Below, you’ll find a long-stay travel insurance comparison that shows you the differences in coverage among the Heymondo, World Nomads, Travelex, and SafetyWing plans.

Emergency Medical Expenses | $250,000 | $100,000 | $50,000 | $250,000 |

Deductible | $100 | $0 | $0 | $250 |

Medical Expenses Paid Upfront | Yes | No | No | No |

COVID coverage | Testing, treatment, and quarantine | Treatment and quarantine | Treatment and quarantine | Testing, treatment, and quarantine |

Medical Evacuation & Repatriation | $500,000 | $300,000 | $500,000 | $100,000 |

Trip Cancellation | Optional | 100% of trip cost up to $2,500 | 100% of insured trip cost up to $50,000 | ❌ |

Trip Delay | $450 | $500 ($250/day) | $2,000 ($250/day) | $200 ($100/day) |

Baggage Loss | $1,700 | $1,000 | $1,000 | $3,000 |

LONG-STAY TRAVEL INSURANCE COVERAGE COMPARISON |

||||

Long-term travel insurance price comparison

If you want a better idea of how much long-term travel insurance costs based on the length of your trip and/or the specific coverage you choose, below is a chart comparing the prices of 1-month, 3-month, 6-month, 8-month, and 1-year long-term travel insurance as well as the prices of long-stay travel insurance, annual multi-trip travel insurance, and cancellation insurance.

The price of long-term travel insurance will be impacted by several different factors, including your age, nationality, and state of residence (if you live in the US).

To give you an idea of how much insurance for long-term travel costs, I’ve used the example of a 30-year-old American citizen who lives in Pennsylvania and needs worldwide coverage to generate quotes for this long-stay travel insurance price comparison.

Types of travel insurance/length | ||||

|---|---|---|---|---|

Emergency Medical Expenses | $250,000 | $100,000 | $50,000 | $250,000 |

1-month travel insurance | $126.99 | $212.55 | $105 | $82.20 |

3-month travel insurance | $319.30 | $496.30 | $321 | $246.60 |

6-month travel insurance | $525.30 | $904.69 | $403 | $493.20 |

8-month travel insurance | $663.30 | $1,271.69 | $403 | $657.60 |

1-year travel insurance | $938.30 | $1,809.38 | $404 | $997.36 |

Long-stay travel insurance | Purchase for 3 months, then renew as many times as you want for up to 8 months at once | You can buy up to 6 months at once | You can buy up to a year at once | You can buy up to a year at once or renew every 4 weeks |

Annual, multi-trip travel insurance | $197.96 | ❌ | ❌ | ❌ |

Cancellation insurance | $91.87 (for 1-year trip, worldwide coverage) | Included | Included | ❌ |

LONG-TERM TRAVEL INSURANCE PRICE COMPARISON |

||||

Best long-term travel insurance

As you can see from the charts above, each of the four long-term travel insurance plans I compared has its merits.

Heymondo offers the highest emergency medical expense coverage, plus it’s the only insurance for long-term travel that pays your medical expenses upfront, so you don’t need to file a claim after your trip to get reimbursed. I will say, however, that it’s not the cheapest long-haul travel insurance and it does have a deductible of $100 for emergency medical expenses. Still, I do think it is the best long-term travel medical insurance if you want ease and convenience.

SafetyWing’s Nomad Insurance also provides very good coverage, but their deductible for emergency medical expenses is $250. In spite of this slight drawback, SafetyWing stands out as the best insurance for digital nomads since you can sign up for a plan and it will automatically be renewed every four weeks.

Best long-term travel insurance

Travelex, on the other hand, has the cheapest travel insurance for long-term travel (for trips of six months or more). For shorter trips, there are other, cheaper options. Travelex’s plan has no deductible, but its emergency medical coverage is also very limited, so I would think twice before going on a long-term trip with such a small amount of coverage.

Last but not least, World Nomads offers the best gap year travel insurance. The emergency medical expense coverage is perhaps a little low, but it is at least higher than Travelex’s medical coverage. There is no deductible for medical expenses, but you will need to pay out of pocket and then file a claim to get reimbursed if you receive emergency medical treatment.

As you can see, the best long-stay travel insurance for you will depend on your needs and type of trip, so keep reading to learn more about each plan.

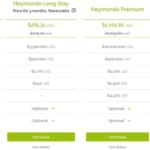

1. Heymondo, the best long-term travel medical insurance

Personally, I consider Heymondo the best long-term travel medical insurance since its Top plan provides the highest amount of emergency medical expenses and evacuation and repatriation coverage. It’s also one of the only types of travel insurance with COVID coverage that covers COVID testing required by a doctor. Moreover, you can easily extend your plan by anything from two weeks to eight months whenever you want to.

Best of all, you won’t have to worry about waiting to get reimbursed for medical expenses since Heymondo pays your medical expenses directly and upfront for you, removing the hassle of the claim-filing process. Heymondo also makes it easy to tailor your insurance for long-term travel to fit your needs since you can add optional electronic and/or adventure sports coverage to your plan.

Heymondo’s Top plan does have its limitations, though. There is a $100 deductible for medical expenses, which means you’ll have to pay $100 towards any medical bills before Heymondo pays the rest for you. This long-stay travel insurance also lacks trip cancellation coverage; you will need to buy that coverage independently here.

| PROS | CONS |

|

|

If you want cheap long-term travel insurance, Heymondo is ideal; its plans already provide very good value for the money, plus you can save an extra 5% on their insurance with the discount link below.

Heymondo is also the best travel insurance company for single trips. We currently have their travel insurance and have used their assistance app more than once. Heymondo has always been there to help us when things go wrong during our trips.

2. World Nomads, the best gap year travel insurance

If you’re taking a gap year, you’re probably interested in breaking out of your comfort zone and having a real adventure. In that case, World Nomads is the perfect travel insurance for living abroad for a year and trying new things.

Its Standard plan includes adventure sports and activities coverage, so you can try everything from trekking and ice fishing to hockey and horseback riding and still be covered for accidents and injuries. Moreover, you’ll benefit from solid overall coverage for emergency medical expenses, evacuation and repatriation, trip cancellation, trip delay, and baggage loss.

Even better, there’s a $0 deductible for medical expenses, so you won’t have to pay a cent out of pocket toward your medical bills. However, World Nomads’ long-term travel insurance is the most expensive out of all the ones I compared, so if you want to save a lot of money and get similar or better coverage, Heymondo may work better for you.

| PROS | CONS |

|

|

3. Travelex, the best travel insurance for long-term travel

Travelex’s Travel Select long-trip travel insurance has a lower amount of emergency medical coverage than the other insurance plans I have compared, and I personally wouldn’t feel protected traveling with such a low amount of medical coverage on a long-stay trip. However, Travelex is a viable option if you’re traveling on a budget for more than six months because it’s really cheap (and has a $0 deductible for medical expenses)!

Travel-related coverage is another story since Travelex has the highest amount of trip cancellation and trip delay coverage of all the plans I compared. It’s the best plan to choose if you anticipate experiencing any travel mishaps. You’ll also enjoy great baggage loss and evacuation and repatriation coverage.

If you would rather benefit from more medical coverage for a similar price, Heymondo is the best choice for you.

| PROS | CONS |

|

|

4. SafetyWing, the best insurance for digital nomads

SafetyWing’s Nomad Insurance lives up to its name by being the best insurance for digital nomads. Not only is Nomad Insurance a cheap long-stay travel insurance, but it also provides a high amount of medical-related and baggage loss coverage.

On top of that, you can choose to have your insurance renew itself automatically every 28 days. Automatic renewal will save you time and money; ensure you don’t forget to renew so you’re always covered; and provide you with more flexibility if you haven’t decided when to end your trip yet. Just select a start date (but not an end date) when you buy Nomad Insurance and keep renewing until you want to go home, at which time you can select an end date.

Nothing’s perfect, however, and unfortunately, SafetyWing’s Nomad Insurance is no exception. There’s a $250 deductible for medical expenses, which means you’ll have to pay $250 out of pocket for medical treatment before SafetyWing will cover medical expenses for you.

SafetyWing also lacks trip cancellation coverage, which can be very useful if you have to cancel a trip due to weather, illness, injury, or many other reasons. If you want a lower deductible, go with Heymondo instead, and if trip cancellation coverage is important to you, choose World Nomads or Travelex.

| PROS | CONS |

|

|

What does long-term travel insurance cover?

The best travel insurance for long-term travel will usually include the following types of coverage:

- Emergency medical expenses: This is probably the most important type of coverage as well as the coverage you are most likely to need while traveling. Accidents, injuries, and illnesses can happen at any time, so having emergency medical expense coverage will ensure that you don’t have to pay out of pocket for hospitalization or medical transportation.

- Evacuation and repatriation: Hopefully, you’ll never have to use evacuation and repatriation coverage, but it is useful to have. Insurance for long-term travel with evacuation and repatriation coverage will pay for the transportation costs of taking you from a remote area to the nearest hospital or sending you back to your home country if you fall seriously ill or have an accident.

- Trip delay: Unfortunately, travel does not always go smoothly; your flight could be delayed due to inclement weather or an airline issue. If that does happen, long-stay travel insurance’s trip delay coverage will cover expenses, such as meals and accommodation, that are incurred because of a several-hour delay.

- Baggage loss: Even when you take precautions to keep your belongings safe, there’s still a chance an airline could lose or damage your bags, or a pickpocket could take your purse. In any case, long-term travel insurance with baggage loss coverage will reimburse you for any valuables that are lost or damaged, so you won’t have to replace them with your own money.

Is long-term travel insurance worth it?

Ultimately, yes, long-term travel insurance is worth it for extended trips, working abroad temporarily, and taking a gap year. It’s also a great alternative for international student insurance. In all of these situations, insurance for long-term travel will ensure that you get the medical- and travel-related coverage you need without having to break the bank.

Is long-term travel insurance worth it?

As you’ve seen in the long-term travel insurance comparison chart above, Heymondo is the best long-stay travel insurance in terms of medical coverage. It offers the highest amount of emergency medical expense and evacuation and repatriation coverage.

Heymondo’s extended-stay travel insurance also provides the convenient flexibility of being able to renew your policy for periods from two weeks to eight months, which is perfect if you haven’t yet decided when you’ll end your trip. To top it all off, you can even get 5% off their insurance just for being a Capture the Atlas reader.

If you’ll be traveling for more than six months and you’re looking for the cheapest long-stay travel insurance, then Travelex may be better for you. Just be aware of their plan’s lower amount of medical coverage.

If you have any questions about long-term travel insurance, feel free to comment below and I will happily help you out!

Hi Ascen, we are US citizens and plan to spend about 6 months of the year in California and 6 months abroad. We have lived in California and in the past had insurance with our jobs which will now be no more. So the question is when we are are in California what is our insurance option so we can visit doctors, dentists etc. Thank you

Hi Sonu, you need standard health insurance for California and travel insurance for traveling out of the States. Travel insurance won’t cover routinary medical appointments.

Let me know if you have any questions,

Ascen

Good day. Could I get overlapping coverages to address different issues? Does any of these cover rental car collision insurance during any portion of the stay? If not, what do you recommend for that?

Yes, you can hire different travel insurance to get different coverages. That is no problem.

Ascen

Hi my husband was diagnosed with mestatic melonma in 2021, Weve been traveling back and forth to Moffitt overvs year now. Weve paid out over $7000 just in lodging. Do you have a plan for this??

Hi Lisa,

I’m sorry about that but there is no insurance that can cover that. That is not an unforeseen issue that occurred during a trip that is mostly what travel insurance cover.

Ascen

Hi

There is an age limit on Heymondo 49+ not included. I am 60. Can you recommend any long stay travel insurance for this age group?

Thanks

Karan

Hi Karan, I recommend checking our article on senior travel insurance for the best options for you.

Let me know if you have any questions,

Ascen

Hi! Do you know if you need basic medical coverage from your home country before purchasing any of these insurance plans presented above? My situation is a bit complex. I am a Canadian citizen currently living abroad (non-resident of Canada), therefore I have no basic Canadian health coverage. I am currently covered by the country I reside in (Qatar), however, once I leave, I will no longer have a residency permit and therefore no coverage here either. So when I leave, I won’t have coverage anywhere. I am planning on leaving to travel for a year, so I need long-term travel and medical coverage.

Hi Marisas, please take into account that these long-term travel insurance are travel insurance. That means that they don’t cover routine health checks or chronic diseases. They only cover you under unforeseen problems. For example, if you hire one of these long-term travel insurance and have a car accident during a trip and need surgery, the travel insurance will cover but it won’t cover cancer treatment, for example.

Let me know if you have any questions,

Ascen

Hi can you recommend a travel insurance for a 7 month European trip for wife and self age 59 CA residents- many thanks

Hi Edward,

Please check the coverage for the insurance recommended in this article and choose the one that is best for you.

Ascen

Hi Were planning to travel continuously for one year to Europe, Asia & med cruise. Is there a travel insurance that can cover this? Most insurances will require you to go back to your home country (US) after 60 to 90 days. Thanks

Hi Nate, I don’t believe you need to get back to the US with the Heymondo Long-Term Travel Insurance. Have you checked it out?

Ascen

Hi Ascen

We are a male 57years and female 58 years and we are travelling to south Africa to include Botswana Namibia Mozambique,Angola Zambia and Lesotho, we are shipping our car from Australia into south africa and will be travelling for two years

we both hold Australian and UK passports

Could you please recommend a medical insurance for this trip , we are not to bothered about trip cancellation baggage etc any help would be appreciated

We have used world nomads previously but would consider others as well

Thank you ag and rg

Hi Antony, that trip sounds amazing! If you’re doing a long-term trip like that one, I recommend Heymondo since they pay all medical expenses in advance. Just be aware of the 100$ deductible per claim.

Said that their price is very competitive and they have very high coverage.

Let me know if you have any questions,

Ascen

Looking for long term insurance for cancel for any reason plus Covid coverage.

Hi Carol,

I recommend purchasing separately a long term travel insurance with Covid Coverage (I recommend this one), and a cancel for any reason policy.

Let me know if you have any questions,

Ascen

Interesting that this features Travelex and then notes: “Can get similar or better coverage for a more affordable price”

From whom?

Hi Clint,

As you can see in the different comparison charts (coverage comparison chart and price comparison chart), Travelex is the one with the lower coverage, by far, and it’s only worth checking for 6-month insurance or more.

Let me know if you have any questions,

Ascen

Hi! Do you know if you need basic medical coverage from your home country before purchasing any of these insurance plans presented above? My situation is a bit complex. I am a Canadian citizen currently living abroad (non-resident of Canada), therefore I have no basic Canadian health coverage. I am currently covered by the country I reside in (Qatar), however, once I leave, I will no longer have a residency permit and therefore no coverage here either. So when I leave, I won’t have coverage anywhere. I am planning on leaving to travel for a year, so I need long-term travel and medical coverage. Thanks!

Hi Melanie, no you don’t need it. You will need just long-term travel insurance and you will be covered wherever you go. Also in your home country as long that you’re traveling there and use the insurance just for emergencies (not regular checks, ongoing problems, chronic diseases, and things like that). In your situation, I think the long-term travel insurance of MONDO is your best bet.

Let me know if you have any questions,

Ascen