When traveling abroad, get a policy from one of the best travel insurance companies. You can get a 5% discount on Heymondo, the only insurance that pays all medical bills upfront for you, HERE!

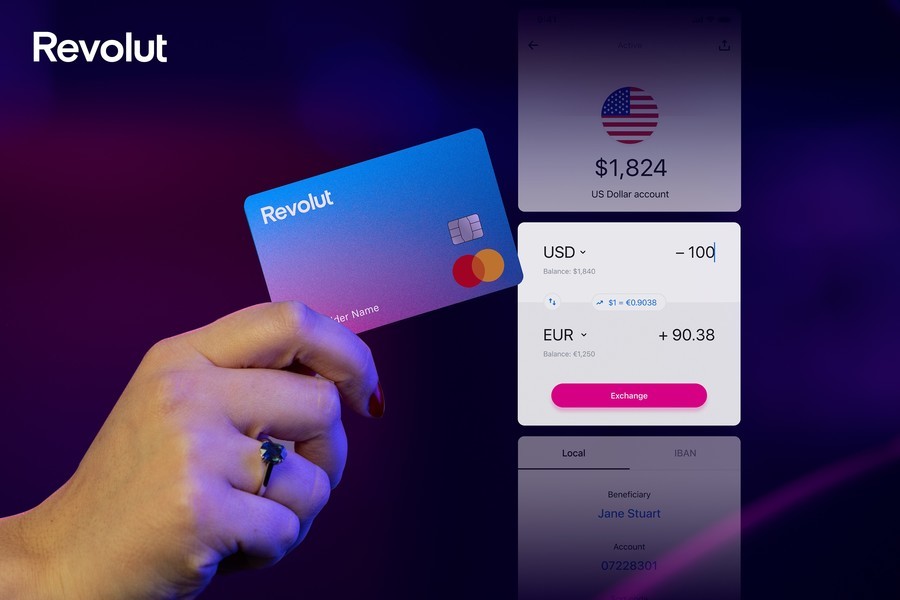

The Revolut prepaid card is one of the cards we always carry with us while traveling since it allows us to pay and withdraw money abroad without pesky currency exchange fees. Moreover, Revolut lets us carry out transactions in different currencies, such as changing from one currency to another when the exchange rate is more favorable.

I had read many Revolut reviews, but what convinced me to try it was hearing about my cousin’s experience. He went to London for a job opportunity and used his Revolut USD account to pay for his expenses in the UK. Once he started working, he added money to his Revolut prepaid card with British pounds, which he used to pay for his expenses when he came back to the USA.

Revolut works in the U.S., and many other countries, which is great for us since we travel to different countries most of the year. So, in this guide, I’ll tell you all about Revolut, including what it is exactly, how it works, and why it’s an excellent financial app for expats and frequent travelers.

- What is Revolut?

- How does Revolut work?

- Types of Revolut cards

- How to apply for a Revolut card

- How to use Revolut abroad

- Revolut fees

- Revolut card reviews

Before we begin, I’ll tell you that we use Revolut in addition to other cards to help save money while traveling, like the Wise card. In this guide, I’ll focus on Revolut and how you can use it to make payments while avoiding currency exchange fees, withdraw money from foreign ATMs, and more.

What is Revolut?

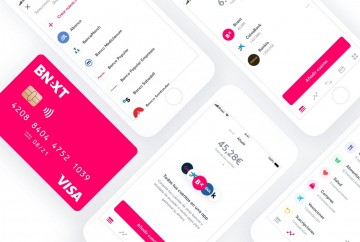

Revolut is a financial technology company that originated in the UK in 2015 and launched in the U.S. in 2020. Over 55 million people worldwide use this financial app to make payments abroad, exchange currencies, get paid in other countries, and more.

With your Revolut prepaid card, you can withdraw money from 55,000+ in-network ATMs without fees from Revolut (third-party fees may apply). Moreover, the card allows you to change your currency when the exchange rate is more favorable, so you can save more money while traveling.

Some cards available only on paid plans. Fees apply.

Depending on the country, your Revolut card can be a Mastercard or Visa card. For example, in the UK, it’s a Revolut Mastercard, while in the U.S., it can be a Mastercard or Visa. Of course, it doesn’t matter which Revolut card you have, as the exchange rate is based on the actual market rate, so you’ll always get one of the most competitive rates available.

The Standard Revolut prepaid debit card has no monthly plan fees (excluding the shipping cost), which makes it one of the most advantageous cards for travel out there. Also, since it’s a financial super-app, you can handle your transactions in the Revolut app, including opening an account and ordering your card.

Revolut frequently updates its products and features, so check out the Revolut Terms and Conditions to see the latest offerings.

How does Revolut work?

The Revolut app can help you locate an ATM, both in and out of network. Money loaded on your prepaid card is held at Lead Bank, Member FDIC. Your funds are FDIC insured up to $250,000 through Lead Bank, Member FDIC.

Revolut’s international bank account number (IBAN) is European, specifically Lithuanian, so deposits to other accounts are made via SWIFT. This means that the funds usually take one to three days to appear in the account.

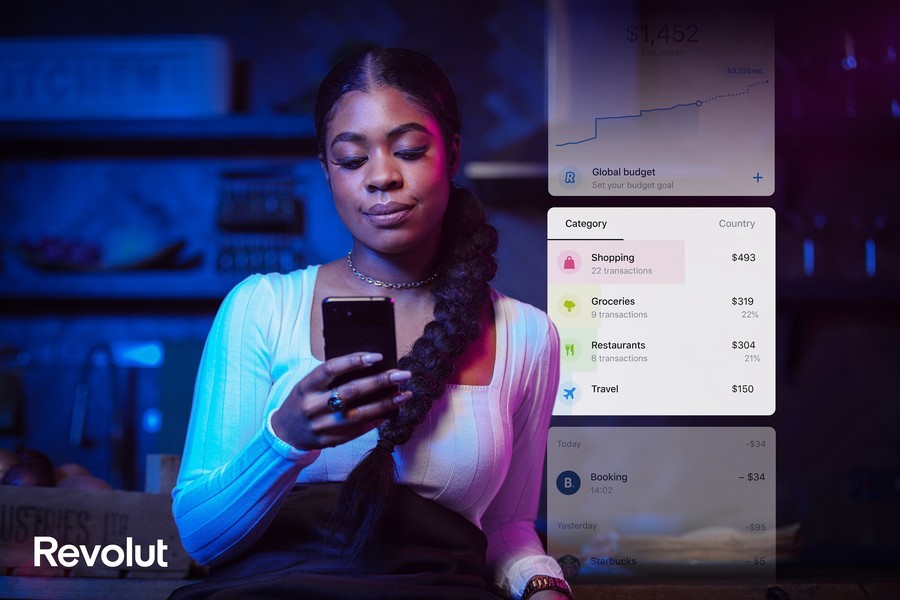

You can also add money to the Revolut card via the app using a debit or bank transfer (fees may apply). Revolut sends automatic spend notifications, and you can see your balance whenever you want, so you’re aware of how much money you have. Revolut uses location-based security, so if it sees that your card was used in an unusual location, it’ll alert you, and you can freeze and block your card right away through the app.

I’ll show you more specific examples of how to use Revolut abroad in the following sections. However, I want to add that during our trips, we use the Revolut prepaid card and the Wise card so we can withdraw more money each month without exceeding the limits and accruing extra fees. So, if you think you’ll have a hard time adhering to the monthly withdrawal and transfer limits, consider getting a secondary card.

Types of Revolut prepaid cards

While we use the Revolut Standard plan, the company offers other types of cards and accounts. I’ll explain each one below, so you can choose the plan that suits your needs. You’ll also find a comparison chart so you can quickly and easily see the benefits of each plan.

Revolut Standard plan (no plan fees)

The Revolut Standard plan has no minimum balance requirement or monthly plan fee. This plan lets you take care of spending and transfers abroad with no hidden fees. Below are the main features you can expect from the Standard plan:

- Currency exchange up to $1,000/month with no hidden fees (rare currency and/or out-of-FX-market hour fees may apply. The weekend markup/time period outside of foreign exchange market hours begins at 5:00 PM ET on Friday and ends at 6:00 PM ET on Sunday.)

- ATM withdrawals up to $1,050/week (or an equivalent amount in a foreign currency) without fees from Revolut at 55,000+ in-network ATMs (third-party fees may apply).

As long as you don’t exceed the monthly limits, you won’t be charged extra fees. These limits aren’t a problem for us since we use our Revolut prepaid card with the Wise card, so we can withdraw extra money as needed each month.

That said, keep in mind that when you order your Revolut card from the U.S., you’ll have to pay a small delivery fee of about $5.00 for shipping.

Revolut Premium ($9.99/month)

The Revolut Premium plan costs $9.99 per month and lets you enjoy the following perks:

- Currency exchanges up to $10,000/month with no hidden fees (rare currency and/or out-of-FX-market hour fees may apply. The weekend markup/time period outside of foreign exchange market hours begins at 5:00 PM ET on Friday and ends at 6:00 PM ET on Sunday.)

- ATM withdrawals up to $1,200/month (or an equivalent amount in a foreign currency) without fees from Revolut at 55,000+ in-network ATMs (third-party fees may apply).

- Up to a 20% discount on international transfers

- Priority Revolut customer support

- Discounted airport lounge access

- Global express delivery option for your Revolut prepaid card

Some cards available only on paid plans. Fees apply.

Revolut Metal ($16.99/month)

The Revolut Metal plan costs $16.99 per month and comes with the most benefits of all the plans:

- Unlimited currency exchanges with no hidden fees (rare currency and/or out-of-FX-market hour fees may apply. The weekend markup/time period outside of foreign exchange market hours begins at 5:00 PM ET on Friday and ends at 6:00 PM ET on Sunday.)

- ATM withdrawals up to $1,200/month (or an equivalent amount in a foreign currency) without fees from Revolut at 55,000+ in-network ATMs (third-party fees may apply).

- Up to a 40% discount on international transfers

- Discounted airport lounge access

- Global express delivery option for your Revolut prepaid card

- Travel medical insurance

- Priority Revolut customer support

- Flight delay insurance and delayed luggage protection

Some cards available only on paid plans. Fees apply.

Revolut cards comparison

Now that you know what Revolut is and how it works, as well as the different Revolut prepaid cards offered, here is a breakdown of each plan.

REVOLUT STANDARD | REVOLUT PREMIUM | REVOLUT METAL |

|

|---|---|---|---|

Price | $0/month | $9.99/month | $16.99/month |

Card delivery | Standard | Express | Express |

No-fee fair usage limit for out-of-network ATM withdrawals (per 30-day period) | $1,050 | $1,200 | $1,200 |

Currency exchanges with no fees (per month) | $1,000 | Unlimited | Unlimited |

Discounted international transfers | - | 20% | 40% |

Priority customer support | No | Yes | Yes |

Travel medical insurance | No | No | Yes |

Flight & baggage delay insurance | No | No | Yes |

This Revolut prepaid card comparison should help you narrow down which plan is suited to your needs.

How to apply for a Revolut prepaid card

Once you find the Revolut plan that works for you, you’ll need to apply for a card, which takes just a few minutes.

Requirements to apply for a Revolut card

First of all, it’s important to know the requirements to request a Revolut prepaid card:

- Be 18 or over

- Proper identification (passport, driver’s license)

As you can see, the requirements are very simple, so you shouldn’t have a problem applying for a Revolut account.

How to open a Revolut prepaid card account

You can open a Revolut prepaid card account from your phone in minutes:

- Click this link and download the Revolut app.

- Enter your phone number and agree to the Terms and Conditions. Then, choose a strong password for your Revolut prepaid card account.

- Revolut will send you a text with a verification code. Enter that code into the Revolut app.

- Enter your personal info, including the address where you want to receive the Revolut prepaid card.

How to open a Revolut prepaid card account

That’s it! You’ll receive a confirmation message stating that your Revolut account has been activated. The next thing to do is to request your Revolut card.

How to order a Revolut card

Use this link to download the Revolut app on your phone and follow these steps:

- Load the Revolut prepaid card with an initial deposit amount using a bank transfer or a credit or debit card you already have. (Fees may apply)

- Click on “Request card.”

- Verify your identity by taking a selfie and a photo of your ID through the app.

- Choose a physical card or a virtual card. I recommend the physical card since some places don’t accept digital versions.

- Select the type of shipment for your card. The Revolut Standard plan comes with standard shipping, but Premium and Metal offer express shipping.

- Create a PIN for your Revolut card.

Once the card arrives, use it for the first time to activate.

As you can see, applying for and receiving your Revolut prepaid card is quick and easy. Of course, depending on the type of plan you choose, you may have a monthly fee ($9.99 for Premium or $16.99 for Metal).

How long does the Revolut card take to arrive?

With standard shipping, it can take up to nine business days to receive your Revolut prepaid card. If you need it right away, choose express delivery to get the card within three business days. (Fees may apply)

It took five days for my Revolut prepaid debit card to arrive with standard shipping.

How to activate a Revolut card

To activate a Revolut card, make a payment with the card at a store, restaurant, or hotel. You could also use the card at an ATM since this requires you to enter your PIN. If you have a virtual card, it’s already activated.

That said, regardless of the type of card you have, you must verify your identity before you can use it.

How to use Revolut abroad

To help you get the most out of your new prepaid debit card, I will explain all the ways you can use Revolut. We use our Revolut prepaid card with the Wise card, particularly when we need to withdraw more than the monthly ATM limit with Revolut. This helps us avoid extra fees.

Below are the different scenarios when you can use your Revolut prepaid debit card.

Revolut ATM withdrawal

Revolut has 55,000+ ATMs in its network, so you can enjoy withdrawals almost anywhere at no cost (third-party fees may apply). Depending on which Revolut prepaid card account you have, you can withdraw up to $1,050 (for Revolut Standard) or $1,200 (for Revolut Premium and Metal) per month (or an equivalent amount in a foreign currency) from out-of-network ATMs with no hidden fees. If you exceed this limit, you’ll pay a 2% commission fee on the withdrawal amount in the same currency.

Revolut ATM withdrawal

When doing an ATM withdrawal via Revolut, you can withdraw money in another currency or change currencies in the Revolut app and withdraw the money later on or the next day. Since the exchange rate is based on the actual market rate, you’ll get the most bang for your buck (rare currency and/or out-of-FX-market hour fees may apply. The weekend markup/time period outside of foreign exchange market hours begins at 5:00 PM ET on Friday and ends at 6:00 PM ET on Sunday.)

Revolut payments

Making a payment with Revolut while abroad is simple. Just pay in the local currency, and Revolut will do the currency exchange for you, using the actual market rate, one of the most competitive rates available. As long as you don’t surpass the plan spending limit of $1,000, you won’t have to deal with fair usage fees (rare currency and/or out-of-FX-market hour fees may apply. The weekend markup/time period outside of foreign exchange market hours begins at 5:00 PM ET on Friday and ends at 6:00 PM ET on Sunday.) If you exceed this limit, you’ll pay a 0.5% fair usage fee. The Revolut Metal plan doesn’t have a fair usage spending limit.

For person-to-person payments within the Revolut network, there is no monthly limit (fees may apply if currency conversion is required to complete your payment). Just use your Revolut app to request and send money or split bills between friends. You can even send money via ACH to local bank accounts at no charge, so it’s one of the top-rated apps for travelers.

Income in different currencies

If you receive income in a currency other than USD, the Revolut prepaid card lets you deposit money in up to 25+ different currencies. This way, you can use them when, where, and how you want.

If you receive direct deposit payments, you can access them from your Revolut account up to two days early. (Early salary subject to employer deposit timing and not guaranteed.)

Change currencies

With the Revolut app, you can quickly and easily exchange currencies. Just choose the amount you wish to exchange and the type of currency. Revolut will even tell you when the exchange rate is most favorable, so you can time your currency exchange for the most appealing time.

Revolut money transfers

You can make unlimited U.S. ACH bank transfers with Revolut with no transfer fees in the app. Revolut also offers domestic USD wire transfers and international transfers with competitive fees.

Send money abroad with Revolut

You can send money abroad or make a transfer with Revolut in another currency right in the app. Remember that you may have to pay a conversion fee if the transfer is in a different currency than that of your Revolut account (rare currency and/or out-of-FX-market hour fees may apply. The weekend markup/time period outside of foreign exchange market hours begins at 5:00 PM ET on Friday and ends at 6:00 PM ET on Sunday.)

Other things you can do with the Revolut app

In the Revolut app, you can share trip expenses with your friends if they have a Revolut account. Alternatively, you can set up recurring payments to other people in the Revolut network.

How to add money to a Revolut card

Adding money to your Revolut account is super simple. Open your Revolut app and click on “Add money” on the home screen. This will open a menu with different options.

How to add money to a Revolut prepaid card

You can then add money using a debit card, or you can add money to your Revolut account using a bank transfer. If your device supports Apple Pay or Google Pay, you can add money this way, too. (Fees may apply.)

Which currencies work with the Revolut card?

You can use Revolut in 140+ currencies, but you can only do international transfers in these currencies: AED, AUD, BGN, BRL, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, IDR, ILS, INR, JPY, KRW, MXN, MYR, NOK, NZD, PHP, PLN, RON, SAR, SEK, SGD, THB, TRY, USD, and ZAR.

Revolut fees

There is an ATM withdrawal limit of up to $1,050* per month (Revolut Standard plan) or $1,200* per month (Revolut Premium or Metal plans). If you exceed your plan’s limit, you’ll have to pay a commission fee of 2% of the value of the withdrawal amount.

*Or an equivalent amount in a foreign currency.

If you have a Revolut Standard plan, you can exchange up to $1,000 per month, after which you’ll be charged a fair usage fee of 0.5% on additional amounts.

Regardless of which Revolut prepaid card you have, there is a 1% markup on foreign transactions outside of FX market hours due to market closures, so be aware of that. (The weekend markup/time period outside of foreign exchange market hours begins at 5:00 PM ET on Friday and ends at 6:00 PM ET on Sunday.)

I recommend having another card that you can use in addition to Revolut, so you can avoid extra fees. For example, we use our Revolut card as well as our Wise card.

Revolut card pros and cons

Before you sign up with Revolut, it’s important to look at the main benefits of the Revolut prepaid card, as well as its drawbacks.

| PROS | CONS |

|

|

Again, we travel with the Revolut prepaid card as well as the Wise card to avoid going over those monthly limits, which is the only disadvantage that would affect us the most.

Revolut customer service

The Revolut app is intuitive and user-friendly, so you can manage your money and transactions in one place. However, if you need to contact Revolut customer support, you can do so in the following ways:

Revolut phone number

If you want to block your card because it was lost or stolen, you can do so in the app or call the automated Revolut phone number at +1-844-744-3512. Since it’s an automated number, it won’t call you back, but it will provide recorded information on how to block your card.

Revolut live chat

Revolut’s live chat is a quick and simple way to contact customer support since it’s available 24/7.

Just open your Revolut app and go to the menu in the upper left corner. Click on “Help”, then “New chat”, and you’ll be connected to one of the customer service agents. If you have the Premium or Metal plan, you’ll get priority support.

Revolut card review

When my cousin explained his experience with Revolut to me, I had recently moved to the United States, so I decided to give it a try. While my cousin had great things to say about Revolut, I didn’t have a great experience at first because U.S. banks don’t have IBANs. So, putting money into my Revolut account from the United States was at first a hassle. Then I found out that adding money to a Revolut card using a debit card was very easy, so I’ve been doing it that way. (Fees may apply)

Revolut card review

Of course, Revolut has been the most beneficial for us when we take trips, especially when traveling abroad, where we rely heavily on my Revolut prepaid card.

I’d also like to share some Revolut reviews from other friends and family members:

- As I mentioned, during my cousin’s trip to London, he was easily able to exchange his money from USD to GBP. He also likes how secure Revolut’s virtual cards are, and that you can link it to Apple or Google Pay.

- My brother also uses Revolut abroad, and on his last trip to Colombia, his wallet was stolen. Fortunately, he was able to freeze his Revolut card in a matter of seconds through the app. With the rest of his cards, he had to make a phone call, which took up a lot of time.

- Finally, my friend Sarah went to study Spanish in Mexico, and she paid for her expenses with the Revolut prepaid card.

You can check out more Revolut prepaid card reviews on Trustpilot.

FAQs about Revolut

If you have any questions about using Revolut, here are the answers to some common questions:

I hope this guide helped you get familiar with Revolut, its features, and its benefits. Remember, Revolut regularly updates its products and features, so check the Revolut Terms and Conditions to see the latest promotions and deals.

If you have any questions about the Revolut app, feel free to leave me a comment below. I’d be happy to hear from you, and I’d also like to hear about your experience with the Revolut card.

Enjoy traveling with Revolut!

Disclosures:

Revolut is not a bank. Fees may apply. Banking services are provided by Lead Bank, Member FDIC. The Revolut USA Prepaid Visa and Prepaid Mastercard are issued by Lead Bank pursuant to licensing by Visa® U.S.A. Inc. and Mastercard International for Mastercard cards. Your funds are FDIC insured up to $250,000 through Lead Bank, Member FDIC. See revolut.com/en-US/ for more details. FDIC insurance does not protect your funds in the event of Revolut’s failure or from the risk of theft or fraud.

I don’t have my Pin code anymore.

How can I obtain a new one?

Thank you

Hi Marc,

You can contact Revolut customer support by phone (+1-844-744-3512) or via the app. Tell them you forgot your PIN and they’ll help you set up a new one. Good luck!

I would like to warn readers. Revolut charges a very high fee for topping up your account using your bank card. To transfer $5000, I was charged almost $150.

Hi Yegor,

Revolut charges a fee if you use a prepaid or international Visa or Mastercard (1.3% – 1.7%). However, you can avoid these fees by topping up via bank transfer (domestic or overseas). I hope this helps!

Ascen

Yes I received my card in the mail, is it already activated? When I tried doing so it said the card was already in use, so can I use it?

Hi Linda,

To activate your Revolut card, simply use it to make a purchase (if you got the virtual card, it’s already activated). You need to verify your identity upon receiving your card, so if it was already activated when you received it in the mail, I would contact Revolut’s customer support for help.

Hi

I am going to FLORIDA in May, do I convert my saving to USD before I leave the UK

Will I be able to use my card for purchases as I would do in the UK ?

First time I have used REVOLUTE just want to understand how it works, I have the physical standard card

Thank you

Dave

Hi David,

You can use your Revolut card to make purchases in Florida, and Revolut will automatically do the currency exchange for you. Plus, the Revolut app can tell you when the exchange rate is most favorable, so if you want to change currencies in the app, you can do so.

Hello I have revolut card but now when I want open for me write phone number wrong or email address what I have to do right now.thanks

Hi Zana,

I’m not sure what the problem is, but I would recommend getting in touch with Revolut customer support as soon as possible to resolve the issue.

Hello. I just received my card but I don’t have any debit card or other cards at the moment to deposit money to my revolut card. Is there any way I can put cash on my revolut card? I am in Madrid Spain.

Hi Simin,

The Revolut card can connect to your Spanish bank account, so you should be able to transfer money that way.

I am traveling to Italy next week. I converted some my us dollars to Euros at what I believe is a good rate. When I present my Revolut card for payment in Italy will it debit the Euro funds or the US dollars held in my Revolut accoun

Hi Art,

You should be able to pay in the local currency (U.S. dollars), and Revolut will do the currency exchange for you, using the interbank exchange rate.

My granddaughter had her Revolut card stolen while on holiday in Greece. As soon as she realised it was gone she cancelled the card and no money was taken out.

Hi Valerie,

I’m glad she was able to get her card blocked before anyone took her money! I appreciate you sharing your experience with the Revolut card. 🙂

This is probably the most thorough and helpful article I’ve come across since beginning my travel research months ago. And you answer questions on every comment? You’re a rock star! 🥰

Hi Katarina,

Thank you so much! I’m happy to help! 🙂

Revolut will. Not except my email or pass code which I know are both OK s

Hi Christine,

That’s odd. I would reach out to Revolut’s customer support to see what the issue is. It could be that they locked your account or maybe you put in the wrong password. Good luck!

The company says they send the money to my revolut account but i didnt receive the money how many days should i wait until it is in my bank account?

Hi Abdiasis,

It usually takes 1-3 business days for the transfer to complete. I would reach out to Revolut’s customer support if you have any questions or concerns.

Hi,

I have just started with my resolut card and am trying to put money into my resolut account. My bank does not recognise the resolut BSB number and warns against transferring the funds. Why is the BSB not recognisable.

I am a bit confused about whether I have to first put money into the account and THEN load it to my card or just load it directly to the card.

Also, if I have not yet activated my card can I add money to it?

Hi Mary,

Revolut should be able to recognize BSB numbers, so I would try again and make sure the numbers are correct. Also, you should activate your Revolut card before making transfers.

Hi, my card & currency is in GBP & I tried paying with chip & pin for a hotel in euro in person but the card was declined. Why would this be? There is plenty of money on the card to cover the cost of the hotel.

Many thanks

Hi Ciara,

It could be that Revolut put a block on your card. I would reach out to their customer support to see what the issue is.

A good easy to read explanation of how it works, would be interested to know which currencies are supported.

Hi Andy,

Thanks! As for currencies, you can use Revolut in over 140 currencies, but you can only do international transfers in these currencies: AED, AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HRK, HUF, ILS, ISK, JPY, MXN, NOK, NZD, PLN, QAR, RON, RUB, SAR, SEK, SGD, THB, TRY, USD, and ZAR. Revolut plans to add more currencies in the future.

Hi.Can someone seize my revolut account?

Uldis,

Revolut uses location-based security, so if it sees that your card was used in an unusual location, it’ll alert you and you can freeze and block your card instantly right in the app.

How do u cancel after the 3month promo?

From the middle tier to the free one

Hi Deb,

You can cancel or downgrade your plan in the Revolut app settings.

Hi when I go too France do I have too change my pounds into euros or will it do it for me

Hi Maureen,

You have to exchange the currencies, but the Revolut app shows you when the exchange rate is most favorable, so you can get the best rate.

can i apply for a joint card for both me and my partner when we go abroad?

Hi,

Yes, you can apply for a joint account with Revolut. Both you and your partner will have your own cards, but they’ll be for the same joint account.

Thanks for giving us very informative post. This can be very helpful for the people living abroad. You have describe everything that may help people.

Thanks so much for reading!

Sorry, my first message was incorrect.

Would it be possible to transfer Euros from my Turkish bank account to the Revolut card, and if so what is the upper limit of a transfer?

Hi Beverly,

Yes, you can make the transfer. Most currencies have no limit on the amount you can transfer (if there is a limit, it will be specified in the Revolut app).

Hi, fantastic review. I’m based in the UK and I am travelling to Greece next week. Do I understand correctly that ss I have UK Pounds on my Revolut card that I don’t need to convert it into Euros? Or would it be advisable to convert?

Hi Stuart,

I would convert currencies. You can do it right in the Revolut app, and you can see when the exchange rate is most favorable.

Need to transfer and exchange ( euros to sterling ) funds from sale of property in Spain, how can I do this through Revolut?

Hi Tessa,

You can transfer the funds right in the Revolut app.

Hi, I am in tunisia, can I withdraw cash from an atm answer use chip facility

Hi if I have £500 in my account and im going to Italy is it better to convert it to euros on the app before I go

Cheers

Im going into Europe this summer and just purchased my Revolut card. How do my British pounds transfer to euros ?

Hi! If I have multiple currencies in my Revolut account from which currency does it takes the money and how can I change it?

Cheers

Zs

Hi Zsofi,

Revolut uses the currency with the best exchange rate for you, so you don’t need to worry about that.

Ascen

So it does not even make sense to convert to different currencies?

Hi Robin,

It makes sense if your local currency is pretty strong now and you envision that that is going to change in the future, so you exchange the currency now, when it’s favorable for you, so you get a better convertion that what you expect you will get in the future. Does it make sense?

However, if you’re traveling this week, let say from the US to Europe, I doesn’t make sense to exchange money on the app. Let Revolut to do the currency conversion only for what you spend.

Ascen

Hi, I’ve just signed up for an account and topped up my balance. It said the first top up is free so what are the charges to add money to my account please

Hi Innes,

Revolut may charge a fee of 3% of the transaction amount.

Hi

Going to Brazil in 3 days so dont have time to obtain a physical card. Can I use the virtual card to buy items in shops eg groceries. Is there anyway I could use a virtual card to withdraw Brazilian real in Brazil?

Hi Rachel,

You can use the virtual Revolut card, but keep in mind that some stores don’t accept digital payment.

Hello and thank you for your explanations. Very useful.

I hace a GBP Revolut account and added a MXN one to the same account in the app, as u will be travelling to Mexico and stay there for few months.

However, I cannot find a way to transfer funds from my own GBP account and I do not even know how it works. I would be grateful if you could illustrate this to me.

Hi Estela,

You don’t need to add funds to your MXN account to use your Revolut card in Mexico. Revolut will do the exchange conversion only for what you spend. As I say, it only make sense to have different currency accounts:

1. If you receive incomes in several currencies.

2. If your think your local currency will lost its value in the future.

Otherwise, don’t bother on converting into different currencies within your account. You still can travel everywhere, and use your Revolut card, and Revolut will convert to the local currency with the best exchange rate.

Ascen

My revolut card has been locked as I inserted the wrong PIN twice in Cambodia . How can I change my PIN when I am in Thailand?

Hi,

You can contact Revolut customer support by phone (+1-844-744-3512) or via the app for help unlocking your card. Good luck!

Hello, I’ve noticed on the app I cannot buy in a different currency. So, I’ll need to exchange it after it comes into my account. Is this a cost effective way to do it?

Hi Peta, I don’t fully understand what you mean. Can you please explain? With the Revolut Card, you can pay in any currency with your card even if you don’t have that currency in your account.

Ascen