When traveling abroad, get a policy from one of the best travel insurance companies. You can get a 5% discount on Heymondo, the only insurance that pays all medical bills upfront for you, HERE!

With the best travel insurance company, you can enjoy your trips around the world knowing that you’re covered in case any mishaps occur. We always recommend purchasing a top-rated travel insurance plan since anything could happen during your adventures. If you fall ill, suffer an injury, or have to cut your trip short, you’ll be grateful for your coverage.

6 Best Travel Insurance Companies in 2025

There are several great options out there, although our absolute favorite is Heymondo. It stands out as the best health insurance for travel thanks to its price-to-coverage ratio, $0 deductible (in most plans), 24/7 customer support, and the fact that they pay all medical bills upfront and there are no out-of-pocket expenses for policyholders. If that sounds good to you, don’t miss out on a Heymondo discount, which you can get just for being our reader.

Alternatively, SafetyWing is an excellent international travel insurance to consider. It offers some of the cheapest rates for great coverage, although there is a $250 deductible and you’ll have to pay your medical expenses upfront, then file a claim for reimbursement.

Said that, there are other options that we recommend depending on your age or situation, so keep reading to learn all about the best travel insurances of 2025.

Best travel insurance companies

To help you find the perfect policy for your travel needs, I’m reviewing the 6 best travel insurance companies in 2025. Keep reading to learn more about each option and its main advantages and drawbacks.

- Heymondo, the best travel insurance company in 2025

- SafetyWing, a top-rated travel insurance for long-term trips

- IMG Global, the best travel insurance company for seniors

- Travelex, the best travel insurance company for families

- Trawick International, one of the best medical travel insurance companies

- AIG Travel Guard, a top-rated travel insurance for pre-existing conditions

Comparing the best travel insurance companies’ prices & coverages

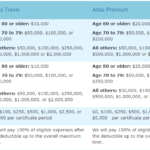

It’s always a good idea to compare travel insurance companies before deciding on a specific policy. To help you out, here is a chart with the prices and coverage of the best travel insurance companies of 2025.

We used the example of a 30-year-old American traveling to Mexico for two weeks, with a trip cost of $2,500. For this comparison, we selected each company’s most affordable option with the lowest deductible to get the best travel insurance for Mexico.

Price | $70.59 | $22.54 | $84.05 | $76.00 | $70.09 | $85.92 |

Deductible | $0 | $250 | $0 | $0 | $0 | $0 |

Medical Expenses Paid Upfront | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ |

Emergency Medical | $250,000 | $250,000 | $250,000 | $15,000 | $50,000 | $15,000 |

Repatriation | $500,000 | $100,000 | $500,000 | $100,000 | $200,000 | $150,000 |

Trip Cancellation | $3,500 | Not covered | 100% of $2,500* | 100% of $2,500* | 100% of $2,500* | 100% of $2,500* |

Trip Interruption | $2,500 | $5,000 | 150% of $2,500* | 100% of $2,500* | 100% of $2,500* | 100% of $2,500* |

Baggage Loss | $1,700 | $3,000 | $1,500 | $500 | $750 | $750 |

Accidental Death | $10,000 | $25,000 | $25,000 | $10,000 | $20,000 | $30,000 |

BEST TRAVEL INSURANCE COMPANIES |

||||||

*Price used for example

As you can see, SafetyWing is the cheapest option, but it includes a $250 deductible per claim, even if you file several claims on the same trip. Also, keep in mind that SafetyWing doesn’t cover your medical expenses upfront, so you’ll have to pay out of pocket, then file a claim for reimbursement.

If you prefer having no deductible and the convenience of having all your medical bills paid upfront, I recommend Heymondo. Not only does Heymondo offer these benefits, but it’s the travel health insurance with the highest amount of coverage and the best price-to-coverage ratio.

I love that you can use Heymondo’s 24/7 support app to chat with a doctor or make a free call to the travel assistance team for help finding the closest medical facility. However, Heymondo is only available for travelers under the age of 69, so if you’re looking for the best travel insurance for seniors, check out one of the other options in this guide.

1. Heymondo, the best travel insurance company overall

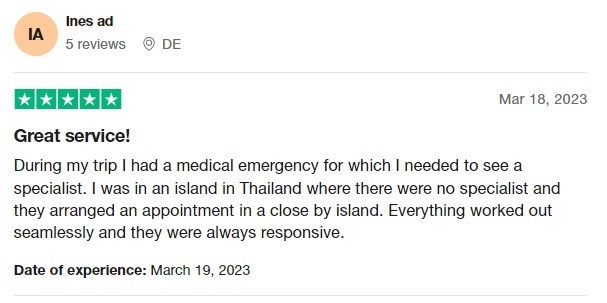

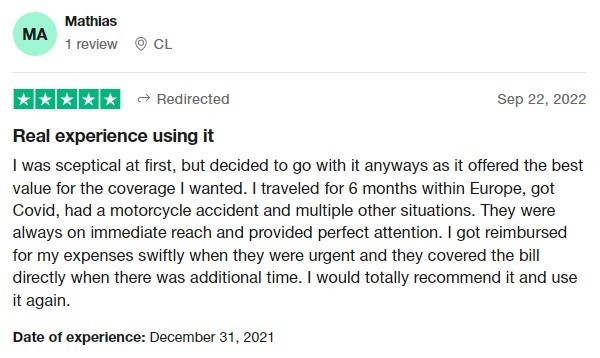

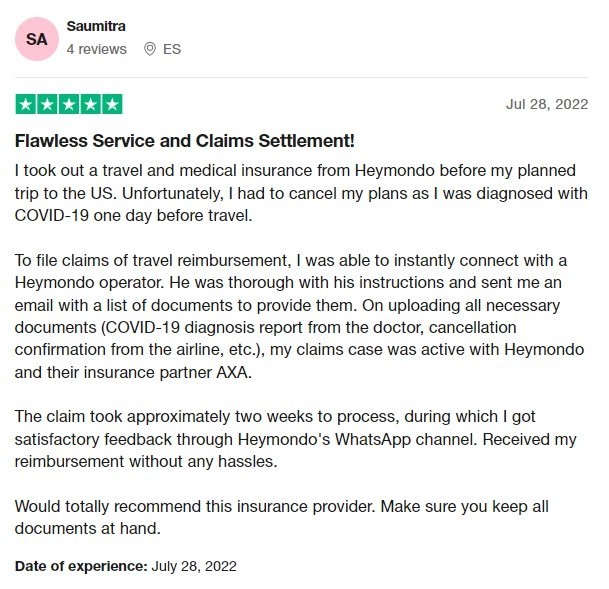

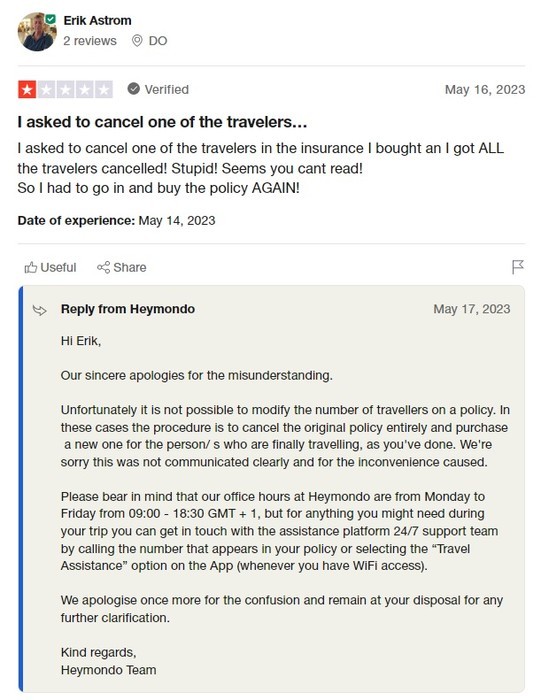

Heymondo is by far the best travel insurance company, whether you want a single-trip policy, an annual multi-trip plan, or a long-term plan.

All of the policies are customizable, including trip cancellation insurance, and cover COVID-19, including doctor-prescribed testing. Moreover, all of Heymondo’s plans provide a great value since you receive a high amount of coverage in all travel- and medical-related categories for an affordable price.

That said, one of the best things about this medical travel insurance is that it pays your medical expenses for you upfront, so you don’t have to pay out-of-pocket and file a claim, which could take months to process for reimbursement. Instead, all you need to do is to contact Heymondo and they’ll direct you to the nearest hospital or doctor while handling the costs for you.

Another thing I love about Heymondo is their customer assistance app, which allows you to get medical advice 24/7 by chat. It’s super useful, and perfect for taking care of smaller incidents without having to halt your travel plans to go to the hospital. You can also call Heymondo’s emergency phone number for free, even if you’re abroad.

Heymondo is among the top-rated travel insurances out there, but no company is perfect. Pre-existing conditions aren’t covered, nor are travelers over the age of 69. Still, as long as you’re healthy and under the age limit, you’ll be covered on all your adventures.

| PROS | CONS |

|

|

We’ve been using Heymondo for years and the customer support has always been outstanding. We used to buy annual multi-trip travel insurance with them but now that we’re traveling full time, we bought a long-term travel insurance policy. If you decide this is the best international travel insurance for you too, remember that you can get a discount just for being our reader here.

Heymondo travel insurance cost

As we explain in our Heymondo insurance review, this company’s cheapest plan is its Medical plan, which only includes emergency medical expenses and evacuation/repatriation.

The most affordable plan with the best coverage is Heymondo Top, which has a $0 deductible and excellent trip protection. The Heymondo Premium plan includes more coverage for a higher price.

Below, you can see the prices for Heymondo’s travel insurance plans, using the example of a 30-year-old person traveling from the United States to Mexico:

PLAN | MEDICAL COVERAGE | 7 DAYS | 15 DAYS | 20 DAYS |

|---|---|---|---|---|

Top | $250,000 | $38.08 | $76.46 | $90.36 |

Premium | $500,000 | $42.67 | $97.71 | $109.22 |

Medical | $500,000 | $34.80 | $69.89 | $82.61 |

HEYMONDO INSURANCE PRICES |

||||

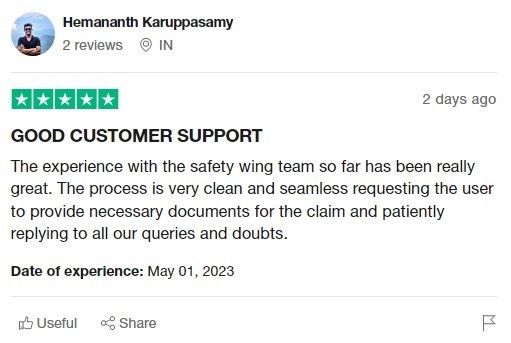

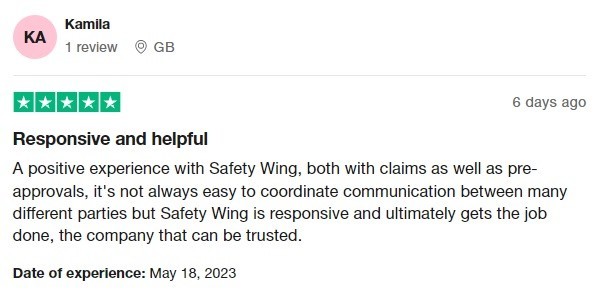

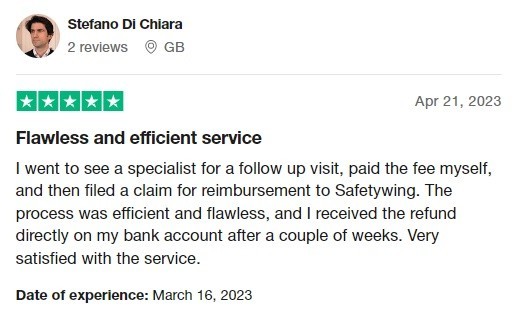

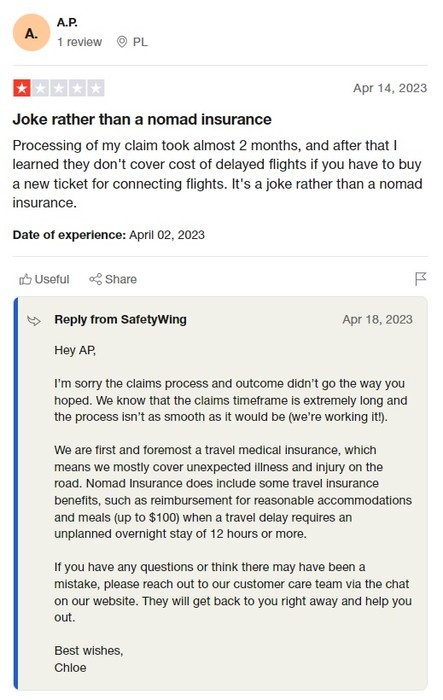

2. SafetyWing, a top-rated travel insurance for long-term trips

If your top priority is medical coverage, consider purchasing a policy from SafetyWing, the best health insurance for travel, particularly for remote workers.

This travel insurance provider mainly focuses on medical-related protection, although limited coverage for luggage, trip delays, and trip interruption is also included. Furthermore, all plans cover travelers worldwide, so you can hop from country to country and still be covered.

SafetyWing is one of the best long-term travel insurances on the market, and it’s great for digital nomads since you can choose to renew your coverage automatically. As soon as you select this option, your coverage will automatically be extended every 28 days until you choose an end date, making it easy and convenient to stay covered.

That said, one drawback of SafetyWing is the $250 deductible for medical expenses, which means that you’ll have to pay $250 worth of medical fees (per claim) before the company covers your bills. Also, keep in mind that pre-existing conditions, unless they’re not chronic or congenital, are not covered, and SafetyWing only covers travelers up to age 69.

If you don’t mind paying a deductible and you only want high-quality medical coverage, SafetyWing is the ideal choice. On the other hand, if you’d prefer a $0 deductible and comprehensive travel-related coverage in addition to excellent medical coverage, Heymondo may be the better option for you.

| PROS | CONS |

|

|

SafetyWing travel insurance cost

At the moment, SafetyWing’s best travel insurance is the Nomad Insurance plan, which is useful for international travelers and digital nomads. However, the company is currently developing a Remote Health plan for individuals, which would provide global health insurance for remote workers.

SafetyWing’s only other plan is the Remote Health plan for companies, which offers health coverage for businesses with remote workers/employees around the world. Since this plan is not travel insurance and the Remote Health plan for individuals hasn’t been released yet, we’ve restricted our pricing information to the Nomad Insurance plan.

Below are SafetyWing’s international travel insurance costs for a 7-day, 15-day, and 20-day worldwide trip:

PLAN | MEDICAL COVERAGE | 7 DAYS | 15 DAYS | 20 DAYS |

|---|---|---|---|---|

Nomad Insurance | $250,000 | $11.27 | $24.15 | $32.20 |

SAFETYWING INSURANCE PRICES |

||||

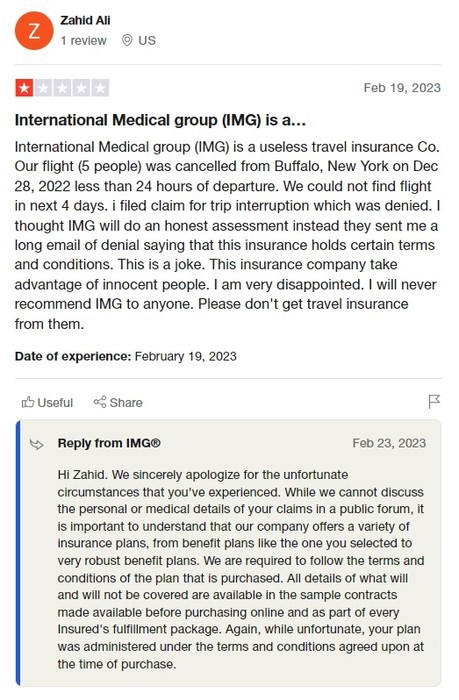

3. IMG Global, the best travel insurance company for seniors

Another one of the best travel insurance companies, particularly for seniors, is IMG Global, which offers comprehensive coverage for short and long-term trips. All of its plans cover travelers up to 99 years of age and include pre-existing condition coverage.

There is also a senior-specific travel insurance plan, GlobeHopper Senior, which is designed specifically for those ages 65 and up. In addition to being one of the best travel insurances for seniors, IMG Global covers U.S. and non-U.S. residents.

With its wide variety of plans (including international insurance for students), you’re bound to find a policy that meets your needs. Along with seniors, many expats agree that IMG Global’s medical-only coverage is one of the best travel insurances for the USA. You can even choose your deductible and medical expenses coverage when setting up your quote.

It’s worth taking the time to compare the different plans so you can see which one works best for you. There are many perks, although younger travelers who want to save money and still get coverage that’s just as good may want to consider Heymondo instead.

| PROS | CONS |

|

|

IMG Global travel insurance cost

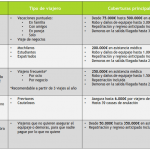

Because IMG has such a vast number of plans, we’ve selected the most relevant ones for this travel insurance comparison. First, the Patriot International plans are travel medical insurance, which means they only cover medical-related expenses.

Next, the iTravelInsured plans offer both travel- and medical-related coverage. The iTravelInsured Travel Lite plan is the most affordable and basic, while the SE and LX versions of the plan offer more coverage. Finally, we’ve included the GlobeHopper Senior plan, a travel health insurance for seniors, so you can get an idea of that plan’s cost.

Below are the prices of Patriot International and iTravelInsured plans for a 30-year-old American taking a 7-day, 15-day, and 20-day trip from the U.S. to Mexico. To generate the price of GlobeHopper Senior insurance, we used the example of a 69-year-old traveling from the U.S. to Mexico for 7 days, 15 days, and 20 days:

PLAN | MEDICAL COVERAGE | 7 DAYS | 15 DAYS | 20 DAYS |

|---|---|---|---|---|

Patriot International Lite | $100,000 | $10.68 | $22.88 | $30.50 |

Patriot Platinum | $2,000,000 | $15.66 | $33.56 | $44.75 |

iTravelInsured Travel Lite | $100,000 | $72.79 | $72.79 | $72.79 |

iTravelInsured Travel SE | $250,000 | $84.05 | $84.05 | $84.05 |

iTravelInsured Travel LX | $500,000 | $159.74 | $159.74 | $159.74 |

GlobeHopper Senior | $100,000 | $49.44 | $105.94 | $141.25 |

IMG GLOBAL INSURANCE PRICES |

||||

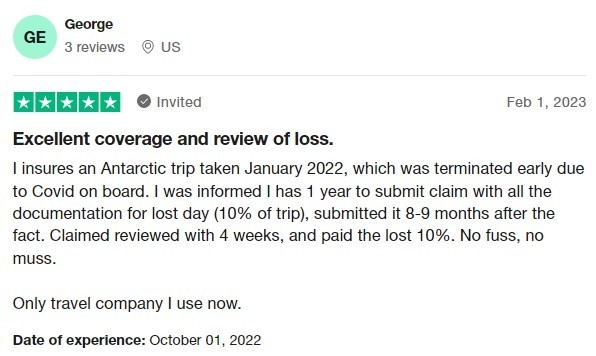

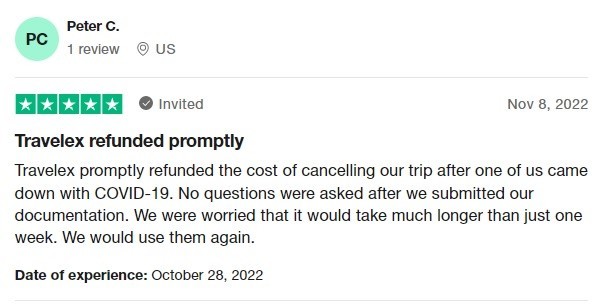

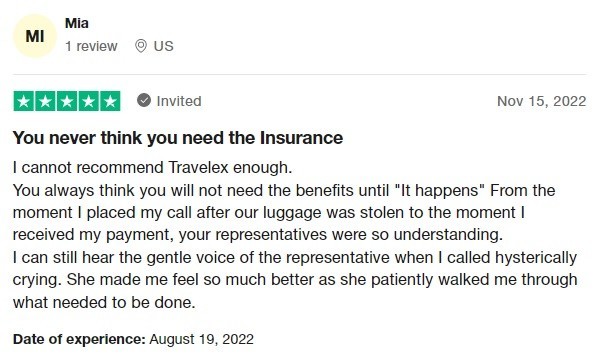

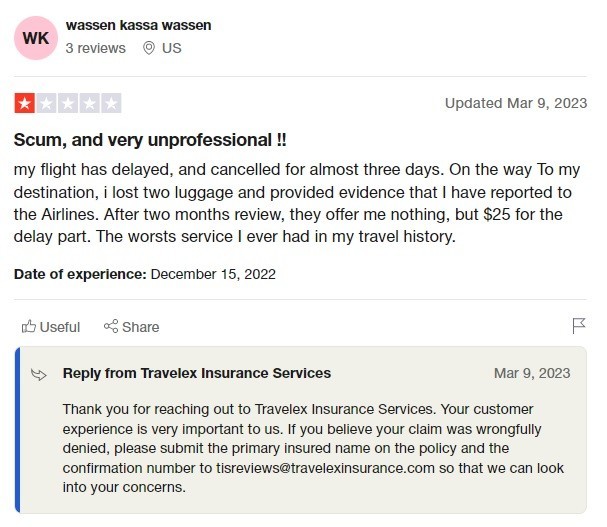

4. Travelex, the best travel insurance company for families

Travelex is one of the best travel insurance companies, especially if you’re looking for American domestic travel insurance. Travelex offers relatively affordable plans with solid protection, including coverage for pre-existing conditions.

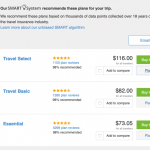

There are two plans, Travel Select and Travel Basic, although we recommend the former, particularly if you have a pre-existing medical condition or you want a higher amount of coverage. If you purchase your Travel Select plan within 15 days of your initial trip payment, you’ll receive a Pre-existing Medical Condition Exclusion Waiver, and your pre-existing medical conditions will be covered.

Another important advantage of this plan is that it covers children under 17 for free. There are even upgrades available for things like rental cars, Cancel for Any Reason, and additional medical coverage. Keep in mind, though, that this plan only covers U.S. residents.

Travelex’s other main travel insurance plan is the Travel Basic plan, which is just that: basic. This isn’t necessarily a problem, but the plan does offer rather low medical expense coverage, particularly for its price, and it doesn’t include pre-existing condition coverage.

| PROS | CONS |

|

|

Travelex travel insurance cost

While the Travel Basic plan may be Travelex’s most affordable travel insurance plan, the Travel Select plan provides better coverage. It’s slightly more expensive than the Basic plan, but includes coverage for pre-existing conditions, COVID-19, and travelers up to age 110.

Below are Travelex’s plan prices for a 7-day, 15-day, and 20-day trip from the United States to Mexico:

PLAN | MEDICAL COVERAGE | 7 DAYS | 15 DAYS | 20 DAYS |

|---|---|---|---|---|

Travel Basic | $15,000 | $76 | $76 | $76 |

Travel Select | $50,000 | $105 | $105 | $105 |

TRAVELEX INSURANCE PRICES |

||||

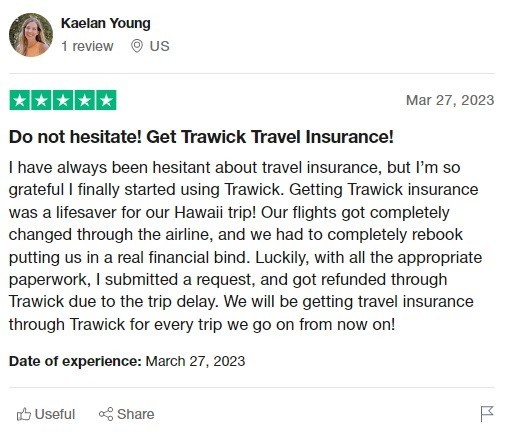

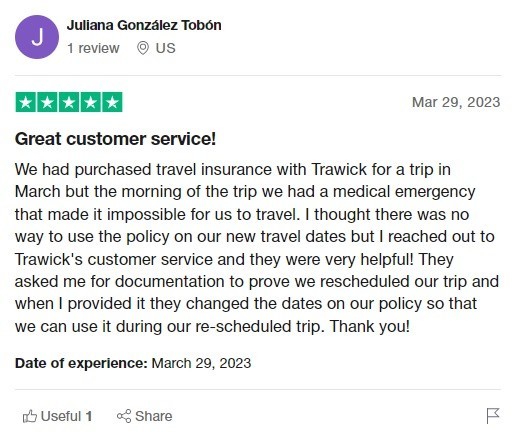

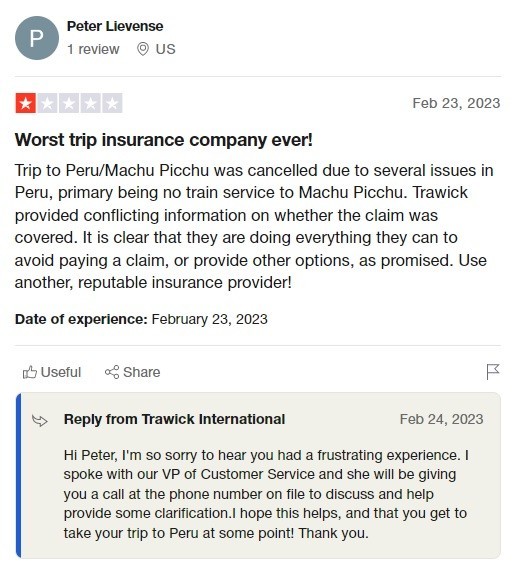

5. Trawick International, one of the best medical travel insurance companies

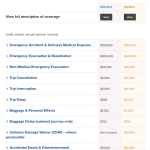

Trawick International is a cheap travelers insurance to consider. It’s one of the best medical insurances for travel, although its benefits are mostly medical-related with some basic travel-related coverage.

Trawick’s plans offer high coverage for medical evacuation as well as coverage for pre-existing conditions. The Safe Travels Voyager plan provides the same amount of coverage for emergency medical expenses as Heymondo, but for a much higher price. You can even add Cancel for Any Reason coverage to make sure that you get reimbursed if you have to cancel your trip for a reason that’s not as serious as illness, death, or inclement weather.

CFAR coverage can also be purchased along with the Safe Travels First Class and Safe Travels Journey plans and can cover up to 75% of the insured trip cost as long as you cancel within 48 hours of your planned departure date. However, there are some limitations to this coverage depending on where you live.

Safe Travels Explorer is the most affordable of the plans we compared, with good trip cancellation and trip interruption coverage. That said, Trawick International has rather low coverage for Emergency Medical Expenses and Baggage Loss, particularly for its price. You can get much higher overall coverage for not much more money with Heymondo.

| PROS | CONS |

|

|

Trawick International travel insurance cost

Trawick International’s travel insurance costs vary depending on how much coverage you need. The Safe Travels Voyager plan provides the highest amount of emergency medical expense coverage ($250,000), while the Safe Travels Single Trip plan offers just $25,000 in coverage.

Below, you can compare plan prices for a 7-day, 15-day, and 20-day trip to Mexico from the U.S. for a 30-year-old traveler:

PLAN | MEDICAL COVERAGE | 7 DAYS | 15 DAYS | 20 DAYS |

|---|---|---|---|---|

Safe Travels Voyager | $250,000 | $101.15 | $125.27 | $141.18 |

Safe Travels First Class | $150,000 | $77.57 | $77.57 | $77.57 |

Safe Travels Journey | $75,000 | $66.07 | $99.69 | $109.53 |

Safe Travels Explorer | $50,000 | $61.91 | $71.29 | $77.15 |

Safe Travels Explorer Plus | $50,000 | $69.31 | $81.02 | $88.56 |

Safe Travels Single Trip | $25,000 | $66.07 | $66.07 | $66.07 |

TRAWICK INTERNATIONAL INSURANCE PRICES |

||||

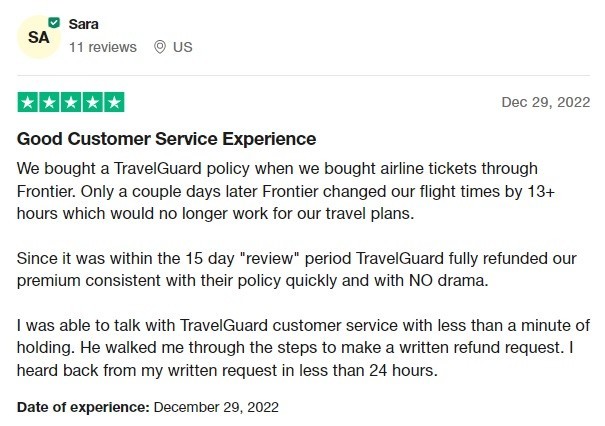

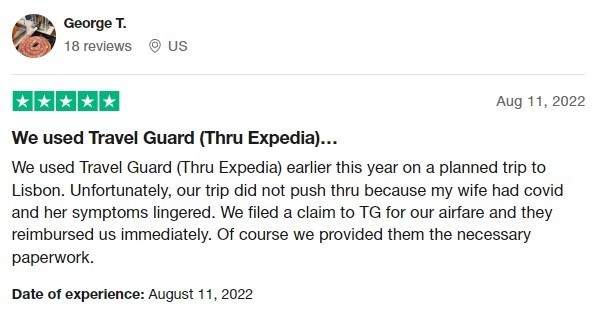

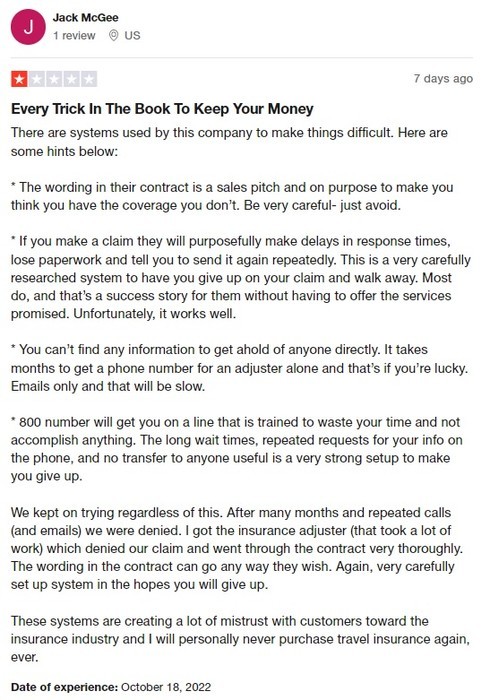

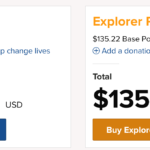

6. AIG Travel Guard, a top-rated travel insurance for pre-existing conditions

If you’re looking for another top-rated travel insurance that covers pre-existing conditions, consider AIG Travel Guard. All of its plans include insurance for pre-existing conditions as long as the policy is purchased within 15 days of your initial trip payment, so you’ll be covered no matter how affordable a plan you choose.

Moreover, AIG offers custom travel insurance plans for single trips and annual trips, but only for U.S. citizens. You can also purchase travel insurance with Cancel For Any Reason coverage from them.

The company has three single-trip policies: Essential, Preferred, and Deluxe. The Preferred and Deluxe plans cover children under 18 for free, and all plans include good trip cancellation and interruption coverage, as well as emergency evacuation and medical expense coverage.

Speaking of medical coverage, this area represents AIG’s biggest weakness. Its plans are some of the most expensive out of all the travel insurance companies we compared, yet AIG offers rather low medical expense coverage, especially considering the hefty price tag.

If you’d prefer a plan with a higher amount of medical coverage for a more affordable price, SafetyWing and Heymondo are better options.

| PROS | CONS |

|

|

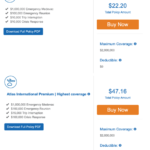

AIG Travel Guard travel insurance cost

As we’ve already pointed out, AIG does not have the best international travel insurance costs; in fact, they’re some of the highest. Below, you can see the prices for AIG’s plans for a 7-day, 15-day, and 20-day trip to Mexico from the United States:

PLAN | MEDICAL COVERAGE | 7 DAYS | 15 DAYS | 20 DAYS |

|---|---|---|---|---|

Travel Guard Essential | $15,000 | $87.63 | $85.83 | $87.02 |

Travel Guard Preferred | $50,000 | $144.83 | $149.50 | $156.77 |

Travel Guard Deluxe | $150,000 | $174.33 | $194.67 | $211.83 |

AIG TRAVEL GUARD INSURANCE PRICES |

||||

What does travel insurance cover?

One of the most important parts of comparing travel insurance policies is to look at what each company offers in terms of coverage. The best health insurance for travel should cover the following circumstances as well as any extras that pertain to your trip.

Emergency medical expenses

Something you’ll notice about all the top-rated travel insurances is that they cover any medical expenses that may result from an illness or injury. This includes things like medical treatment and hospitalization. Many travel insurance providers also cover COVID-19 and treat it the same as any other illness.

Coverage for emergency medical expenses

Emergency medical expense coverage is the most important type of insurance protection, so don’t sacrifice it just to save money, especially if you are looking for travel insurance for the USA, where medical expenses are ridiculous. If you’re looking for a good deal, buy travel medical insurance, which offers a high amount of medical coverage for a very affordable price.

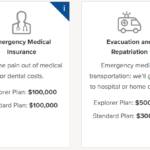

Medical evacuation & repatriation

Evacuation and repatriation are another crucial component of a good travel insurance company, although it often gets overlooked. This type of protection covers you if you get injured while traveling and need transportation to a nearby hospital.

Additionally, if you become so sick that you need to fly back to your home country for medical treatment, your policy will cover the transportation expenses, which can be incredibly pricey. You don’t want to be stuck in a foreign country without proper medical care, so don’t forget about evacuation and repatriation coverage! Maybe you think that since you’re looking for a travel insurance for Europe you don’t need it, but believe me, there is no destination where medical evacuation is not important.

Trip cancellation

Your travel insurance plan should also include some type of trip cancellation coverage. This usually covers reasons like illness, inclement weather, strikes, and jury duty. However, be aware that the majority of travel insurance companies won’t reimburse you if you cancel your trip for a reason that’s not covered by your plan.

Trip cancellation coverage

If you want the option of canceling you trip for any reason and getting reimbursed, look into Cancel For Any Reason (CFAR) insurance. Many companies offer CFAR insurance as an add-on.

Trip interruption

Along the same lines, trip interruption coverage will reimburse you if you need to cut your trip short due to a serious illness, injury, or the death of a family member. The best travel insurance companies offer this type of protection, and work-related issues often fall under this category, too. So, if you need to return to your home country before your trip ends, you’ll receive a reimbursement for pre-paid trip expenses like flights and hotels.

Baggage loss/damage

Anyone who has traveled knows that there is always the risk of your luggage getting lost, damaged, or delayed. It’s always a good idea to have this type of coverage, which will provide a predesignated reimbursement amount so you can buy new toiletries, clothes, and other essentials if something happens to your baggage.

COVID-19 coverage

As I mentioned, many of the best travel insurance companies cover COVID-19 the same as any other illness, so if you come down with the coronavirus during your trip, you can be reimbursed for expenses related to it.

COVID-19 coverage with the best travel insurance

Depending on the company, you’ll be covered for testing, treatment, quarantine, or a combination of all three. We have a complete guide to the best travel insurance with COVID coverage if you want more information.

Extreme sports

Most international travel insurance companies don’t cover extreme sports like skydiving and bungee jumping. However, some providers offer this type of coverage as an add-on, so if you know you’ll be trying some adventurous activities during your trip, it’s worth tacking it onto your plan.

Equipment

Additionally, most of the best travel insurance companies cover things like camera equipment, laptops, and cellphones. However, there is usually a cap on the reimbursement amount (~$500), so you should check with the company before purchasing.

FAQs – Best travel insurance

To finish up, here are the answers to some common questions about insurance for international travel:

I hope this travel insurance company comparison helps you find your perfect plan so you can be fully covered for your trip. Remember that having international travel insurance is better than having no coverage at all!

Again, Heymondo is the best travel insurance of 2025, so if you want to learn more about this company, check out our complete Heymondo review.

Of course, if you have any questions about these travel insurance plans, feel free to leave me a comment below. I’ll be happy to help!

I was prepared to sign up with Heymondo for travel Insurance (Iceland Sept 2023) but found their maximum age for coverage is 69. I’m 73 , in good health, no pre-existings, or health threatening bad habits – do you recommend an insurance company for me ?

Thanks

Hi Dale,

Sure thing! IMG Global has a higher age limit. You can find more information on that company and others in our guide to the best travel insurance for seniors.

Hi, I found your article and your site as one in a million. Thanks for letting us know how to go about getting the best travel insurance. Please, I will want to know which or both insurance pays in advance (1) Heymondo (2) World Nomads.

Hi Lucky, Heymondo is currently the best travel insurance. World Nomads has stopped all activity due to the Covid-19. However, Heymondo is providing insurance covering also the coronavirus medical assistance and testing.

Let me know if you have any questions,

Ascen

I’m glad I found your article. We finally decide to follow your advice and purchasing World Nomads Explorer. Our plan was to hike to the Grand Canyon bottom and I got injured on my way down.

The assistance was great and they covered all the medical expenses in advance. I will buy that insurance if I can make my knee work properly again!

Thanks for letting us know. I have had to use it a couple of times but never for a injurey when hiking. Did you need helicopter rescue? Please let me know.

Dan