If you’re thinking about getting a HeyMondo insurance policy, I’ll give you all the information you need. Dan and I have been traveling with HeyMondo travel insurance for several years and highly recommend it. There have been a few times when we’ve run into a medical emergency or trip cancellation, and Heymondo has always responded quickly and professionally. In short, we always know we’re in good hands with them!

HeyMondo travel insurance review 2025

With Heymondo insurance, you’ll be able to enjoy great protection during your trip at a great price. In fact, HeyMondo is one of the best travel insurance companies on the market, not only for its excellent price-to-coverage ratio. Their travel assistance is 24/7 and they will even pay your medical bills upfront so you can focus on getting better and continuing your vacation without worrying about the bills.

After a few years of traveling with Heymondo (and needing to use it!) I’ve decided to write a complete HeyMondo review to help you determine if this company is a good fit for you. From stomach bugs and drone accidents to missed flights and cancellations, we’ve had to rely on Heymondo quite a bit. Now, I can’t imagine traveling without them.

In this Heymondo travel insurance review, I’ll tell you what you can expect from this company:

- HeyMondo review

- HeyMondo travel insurance plans

- What does HeyMondo cover?

- What’s not covered with HeyMondo?

- HeyMondo travel insurance pricing

- HeyMondo customer service

- HeyMondo refunds & claims process

And if you’ve already decided that you’re ready to purchase a policy, don’t forget to go through our link for a 5% discount on HeyMondo.

Remember, travel insurance is always worth it, so keep reading to learn why Heymondo stands out from the rest, and why you should purchase a policy with them for your next adventure.

My HeyMondo review (after using it for 5+ years and making claims)

We’ve been using HeyMondo for 5 years now and have no plans on switching to another company.

I first got Heymondo’s long-stay travel insurance when I was coming to the United States. Once I decided that I wanted to live here permanently, I stopped renewing my long-stay plan and got annual multi-trip insurance instead.

The only mishap I’ve ever experienced with this company was when I first purchased from them. I was given the Heymondo contact number for the finance department rather than the medical assistance department. The customer support team was super apologetic and quickly got me in touch with the right people, and all this occurred before the app existed, so I don’t even think this mix-up would happen these days.

I was drawn to HeyMondo for its competitive pricing and high coverage limits. Given all the traveling that Dan and I do, we’ve had to rely on Heymondo a few times throughout the years. The most recent and traumatic example of this was on a recent trip through the Peruvian Amazon when our boat capsized and tossed everyone and their luggage into the water. Fortunately, we all managed to get out of the water safely after being dragged along by the river for 15 minutes. While Dan and I didn’t need medical attention, we lost all our equipment, including two laptops, two cameras, five lenses, several hard drivers, and our travel documents.

My HeyMondo review

Heymondo was there for us from the start, offering moral support as well as helping us get connected to the Spanish embassy so we could get back to Spain as soon as possible to obtain new passports. Thanks to our HeyMondo insurance’s electronics coverage, we got $750 each to pay for the photography equipment we lost.

There was another time in Alaska when we had a drone accident and my hand got injured. I was bleeding a lot and got nervous, so we rushed to the nearest hospital without even stopping to remember that we could call Heymondo customer service first and have them arrange the payment in advance. Of course, we only thought of this after receiving a bill for over $3,000! Fortunately, we were able to file a claim via the 24/7 HeyMondo app, and we received a reimbursement two weeks later.

Heymondo travel insurance review

Fortunately, our other stories aren’t as dramatic. On a trip to Ecuador, Dan fell ill with a stomach bug, so we contacted Heymondo right away. They told us which hospital to go to and took care of all the expenses for us. During another trip, our flight was cancelled until the next day, so HeyMondo paid for our hotel and meals. And there was yet another mishap in Iceland when our luggage was delayed, so we had to buy toiletries and other necessities. HeyMondo refunded us for these expenses, too.

Each and every time, Heymondo is there for us. I always know we’re in good hands when we travel, not only because their plans have high coverage, but also because the HeyMondo customer service team is kind, friendly, and super helpful when things go awry.

Is HeyMondo a good travel insurance company? – Based on my own experience

As you’ve seen, we’ve had to use HeyMondo’s coverage benefits quite a few times over the last 5 years, and they’ve never let us down. Even when we run into bad luck or mishaps on our adventures, Heymondo is there for us every step of the way.

In addition to their professional and knowledgeable team, the company offers a great price-to-coverage ratio, and they’ll take care of your medical expenses upfront, so you don’t have the hassle of paying out of pocket.

Is HeyMondo a good travel insurance company?

I know that not every HeyMondo review will be positive, but I wanted to share our experience and why I think it’s one of the best options on the market. Whether you’re looking for travel insurance for Europe, coverage for the USA, or for a worldwide trip, they’ve got you covered.

Before you purchase a policy, remember that you can get a discount by using our link. I also recommend reviewing your Heymondo travel insurance plan very well, so you understand what’s covered and what’s excluded.

Below, you’ll find the main advantages and drawbacks of using Heymondo insurance.

Pros of HeyMondo travel insurance

Whether you’re taking it from me, reading other HeyMondo reviews, or trying the insurance for yourself, you’ll see that this company has way more pros than cons.

From excellent coverage in all categories to being one of the first to offer COVID-19 protection, Heymondo has a lot to offer. Keep reading to see why this travel insurance stands out from the rest.

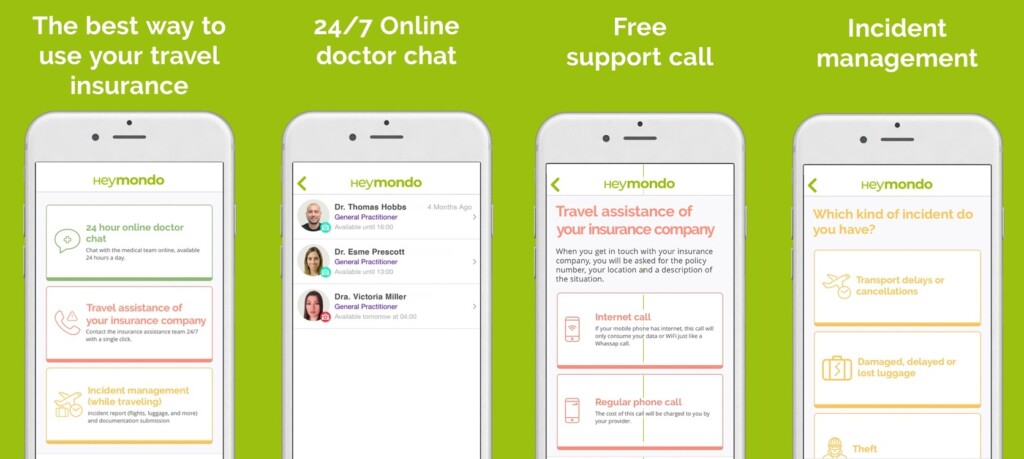

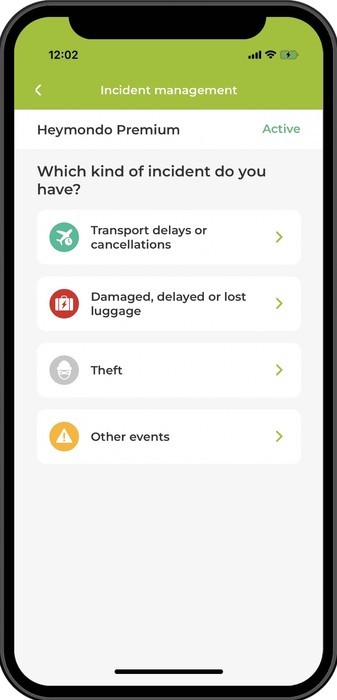

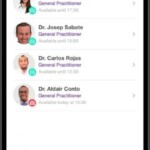

24/7 travel assistance app

When you purchase a policy from HeyMondo, you get access to the 24/7 medical chat. This Heymondo app is invaluable, as it connects you with doctors and specialists. This way, if you run into trouble while abroad, you can get in touch with a medical professional through the app for advice and recommendations. For me is a must-have travel app.

24/7 travel assistance app

The 24-hour medical chat is there for you when you run into minor issues, and for more serious problems, you can always call HeyMondo through the app for free to find out where the nearest hospital is. The Heymondo team will also arrange your payments ahead of time, so you don’t have to worry about the billing process at the clinic or hospital.

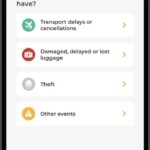

Another great thing about the app is that it comes in handy for other travel assistance needs, such as making claims for non-medical expenses like missed flights and lost luggage. Making a claim through the app is easy and only requires you to upload some documents. This way, you can get reimbursed as quickly as possible.

Medical expenses covered upfront

This leads me to another point about Heymondo insurance: it pays your medical expenses upfront, so you don’t have to pay out of pocket. So, if you get into an accident or fall ill during your trip, just call HeyMondo customer service via the app. They’ll tell you which hospital to go to, and they’ll arrange the billing process for you so all you have to worry about is getting better.

This is our favorite thing about Heymondo, especially when we’re traveling someplace where medical coverage is super expensive. If we do happen to get sick or injured, we know we can call ahead so HeyMondo can take care of the medical expenses for us, and we can avoid paying a huge bill out of our own pocket.

Of course, Heymondo understands that emergencies happen, so if you are in a scenario in which you can’t contact HeyMondo ahead of time, you can always file a claim through the app to request reimbursement.

Extensive coverage

Another advantage of HeyMondo insurance is its excellent price-to-coverage ratio. Heymondo offers high limits for medical and travel-related coverage, making it one of the best options on the market.

The HeyMondo Top and HeyMondo Premium plans include emergency medical coverage for hospital visits, prescriptions, dental procedures, and more, plus repatriation and similar travel-related expenses for yourself and family members.

Extensive coverage

You’ll also have the benefit of trip cancellation insurance, although you should review your Heymondo travel insurance policy to know exactly what’s covered. HeyMondo also covers the costs for lost, stolen, or damaged luggage, and you can add electronics coverage if you want to protect your laptop, tablet, or photography gear.

A wide range of sports and activities are also included, and if you plan on taking a cruise or participating in more extreme sports, you can add on this coverage as well.

Competitive price

Given all the benefits and the high coverage limits offered by HeyMondo, you may be surprised to learn that it’s one of the best deals on the market. After looking at several competitors, we’ve found Heymondo to be one of the cheapest in terms of price-to-coverage ratio.

Unlike many other travel insurance companies, HeyMondo’s cheapest plans still offer a high amount of protection. Plus, most of the plans have a $0 deductible. While it’s not the cheapest travel insurance on the market, you can rest assured that you’ll always get the best value.

Flexibility

Another awesome thing you’ll notice when reviewing HeyMondo is that you can purchase a policy even if you’re already abroad. Just be aware that if you take out a policy after your trip has started, you’ll have to wait 72 hours for the coverage to kick in.

Flexibility

The flexibility doesn’t end there though, as Heymondo offers several great plans. In addition to HeyMondo Top and HeyMondo Premium, they also offer medical-only travel insurance for those who aren’t interested in having travel-related benefits.

Moreover, if you’re purchasing Heymondo’s long-stay insurance, you have flexibility in terms of renewing your policy. After 90 days, you can renew your insurance for another 30, 120, 180, or 275 days.

Easy and fast claims process

The claims process with Heymondo is much quicker than any company we’ve dealt with, so you can expect to get your HeyMondo refund or reimbursement back promptly.

All you have to do is message Heymondo customer service through the 24/7 app and submit any necessary documentation, such as medical records or receipts. Heymondo takes care of the rest for you and typically delivers a result within a couple of weeks, as opposed to months later like with other companies.

Heymondo Covid coverage

Finally, Heymondo’s COVID travel insurance stands out for a couple of reasons. At the start of the pandemic, HeyMondo was the first insurer to cover COVID-19 (even though they technically didn’t have a reason to cover it since pandemics are excluded from coverage).

Heymondo Covid coverage

Proving that they care about customers, HeyMondo included COVID in its policies, covering it as if it were any other illness or disease. This paved the way for other insurers to follow suit and offer Covid coverage in their policies, too.

With HeyMondo’s COVID insurance, you’re covered for any related medical expenses, such as doctor-prescribed PCR tests, treatment, medical quarantine, trip cancellation, and return flights home.

Cons of HeyMondo travel insurance

Of course, no travel insurance is 100% perfect, so this Heymondo review wouldn’t be complete without mentioning the downfalls of this company. While they’re few and far between, there are some cons to consider before purchasing a HeyMondo insurance policy.

HeyMondo age limit

First, it’s important to be aware of Heymondo’s age limit, which is 69 for trips up to 29 days, and 49 for trips of 30 days or more. If you’re looking for the best travel insurance for seniors, I recommend checking our specific guide on that.

HeyMondo deductible (only for long-term plans)

Another thing to be aware of is that HeyMondo’s long-stay insurance has a $250 deductible. It’s a relatively low amount compared to other insurances, and it applies to medical expenses coverage only.

HeyMondo deductible (only for long-term plans)

If you purchase this Heymondo plan, you’re responsible for the first $250 in medical costs. So, if you file a claim for $300, Heymondo will only pay you $50 due to the $250 deductible.

Given all the other positives of Heymondo and its great prices and high coverage limits, I don’t think these two disadvantages should discourage you from checking them out.

Other HeyMondo travel insurance reviews

Although I’ve already told you about my experience, I want to share some Heymondo reviews from others who have used this company. Below, you’ll find positive and negative reviews for HeyMondo travel insurance across different platforms like Trustpilot, Google Play, the App Store, and more.

HeyMondo reviews on Trustpilot

You’ll find lots of HeyMondo travel insurance reviews on Trustpilot, where the company has 1,864 reviews and an excellent 4.5 out of 5 rating. Nearly 90% of reviewers gave Heymondo a 4-star rating or better, with many clients praising the company’s efficient claims process and 24/7 app.

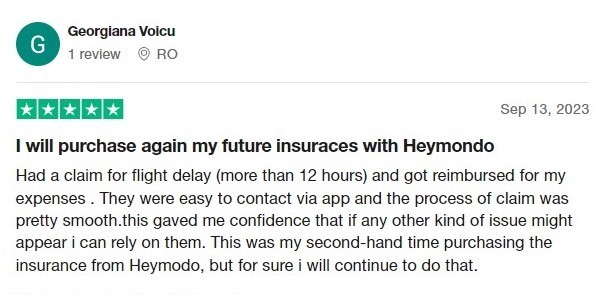

This reviewer explains how easy it was to get reimbursed for a delayed flight by contacting the company through the HeyMondo app:

Here is another positive Heymondo review from a client who had to use their insurance during a trip to Mexico when they had to go to the hospital. Heymondo covered the costs for their medical care and their delayed flight back to Spain:

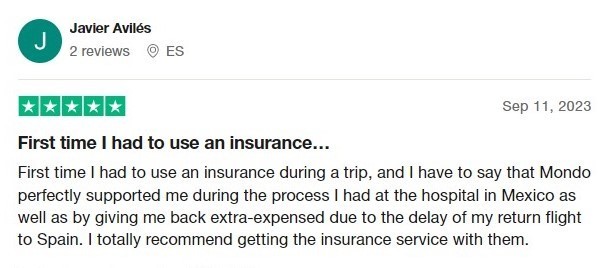

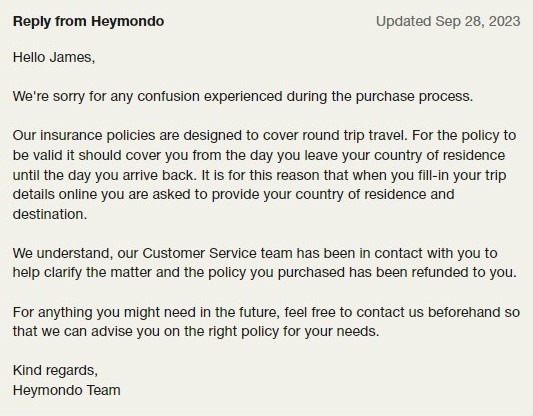

There aren’t many negative reviews for HeyMondo, but it’s only fair to show you an example. This customer had trouble using the website and specified their country of origin rather than their country of residence, which led them to purchase the wrong policy:

HeyMondo was quick to respond:

HeyMondo travel insurance reviews on TripAdvisor

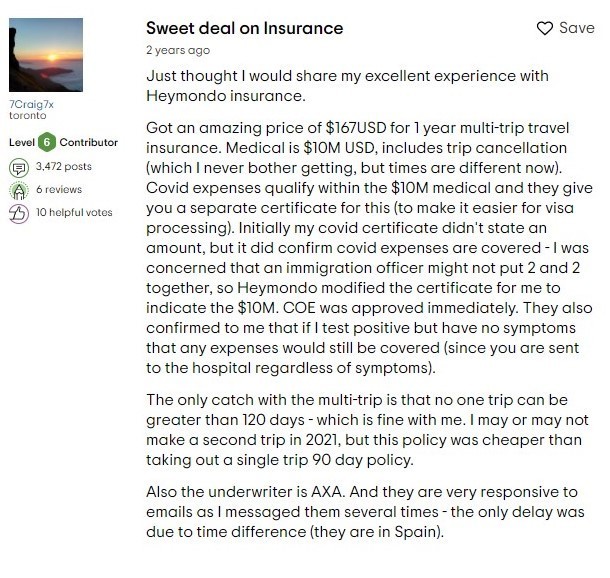

There aren’t too many Heymondo reviews on TripAdvisor, but this one offers some good insights into the customer experience:

This review says that the trip cancellation coverage was a huge plus, and they also had good COVID protection. They were highly satisfied with the price of their HeyMondo insurance for Thailand, as well as the high coverage limits.

A negative aspect that they mentioned in their HeyMondo travel insurance review is that the multi-trip policy only covered trips that were shorter than a few months.

HeyMondo reviews on Google My Business

There are over 100 Heymondo travel insurance reviews on Google My Business. HeyMondo’s average rating is 4.1 out of 5, with most clients praising the company’s customer service. They say that the support team is not only quick to respond but also courteous and friendly. They’re super helpful, particularly in cases when you need medical care while abroad.

For example, this customer wrote a Heymondo review and cited his experience in Asia when he needed medical attention. HeyMondo’s support team was quick to take care of everything:

HeyMondo reviews on Google Play

On Google Play, Heymondo has an average rating of 3.4 out of 5 stars. The HeyMondo app has been downloaded over 50,000 times and there are 179 HeyMondo reviews.

Most of the positive reviews mention how easy it is to get in touch with Heymondo customer service. Other users mention how convenient the app is and how it allows you to manage claims and access your policy with just a few taps.

As for the negative reviews, these are mostly related to user error or customers not fully understanding what’s covered under their HeyMondo insurance policy.

HeyMondo reviews in the App Store

There are fewer Heymondo travel insurance reviews on the App Store, but the company does have a slightly higher rating here of 3.9 out of 5. Of the 29 reviews, there are just a handful of negative ones, with most dissatisfied customers complaining about exceptions and coverage limits. Again, it’s crucial that you double-check your policy, so you know what’s covered by HeyMondo and what’s not.

HeyMondo travel insurance plans

There are different types of Heymondo insurance plans available, so you’ll be able to find one that suits your budget and travel needs.

Currently, we have an annual multi-trip policy with HeyMondo, which covers all the trips we make during the year that do not exceed 90 days. It’s the best option for us since we travel a lot throughout the year, whether we’re doing photo tours with clients, scouting out new locations, or taking a vacation.

To help you find your perfect fit, here is a brief review of HeyMondo’s travel insurance plans:

HeyMondo single trip insurance

Heymondo’s single-trip insurance is perfect if you’re taking a planned trip and want to be covered for unexpected illnesses, accidents, baggage loss, and more.

This type of policy offers coverage for medical expenses, repatriation or early return, luggage, trip cancellation, etc. The price varies depending on your country of residence, the duration of the trip, and your destination, which can be a specific country, several places, or the entire world. It will also depend on whether you purchase a Heymondo Top or Heymondo Premium plan (there is also a medical-only option if you just want health coverage).

The Top plan offers a more affordable price but still includes a high amount of medical- and travel-related coverage. The Premium plan is slightly more expensive and offers at least two times the amount of coverage in the Top plan, plus optional add-ons like adventure sports and cruise coverage, as well as rental car excess.

The single-trip insurance from HeyMondo is the best choice for single, short-term trips that already have confirmed departure and return dates, although you can also buy it if you’re already abroad. To give you an idea of the price, here are the costs for a Canadian traveling to Mexico for 7 days:

HEYMONDO TOP | HEYMONDO PREMIUM | HEYMONDO MEDICAL |

|

|---|---|---|---|

Price | $28.11 | $31.73 | $25.69 |

Medical Expenses | $5,000,000 | $10,000,000 | $10,000,000 |

Repatriation | Included | Included | Included |

Baggage Delay/Loss/Theft | $1,700 | $2,500 | N/A |

Trip Cancellation | $3,500 | $7,000 | N/A |

Trip Interruption | $2,500 | $4,500 | N/A |

HEYMONDO SINGLE TRIP INSURANCE |

|||

HeyMondo annual multi-trip insurance

The annual multi-trip insurance from HeyMondo is the plan we currently have since it’s designed for people who make several trips throughout the year. Just keep in mind that each trip must be shorter than 90 days, and you’ll have to return home to renew your coverage.

If you plan on taking at least four separate trips over the next year, this is a good HeyMondo travel insurance policy to have, as it’ll save you a lot of money in the long run. However, if you’ll be traveling non-stop during the year, a better option is the long-stay insurance, which I’ll talk about next.

We have a complete guide on the best annual travel insurance, but I’ll tell you now that Heymondo’s annual multi-trip plan is one of the top-rated options. It covers your medical expenses, repatriation or early return, baggage loss and delay, trip cancellation, civil liability, and more.

Below, you can see the price and coverage limits for an annual multi-trip policy from Heymondo:

| HEYMONDO ANNUAL MULTI-TRIP | |

|---|---|

Price | $220.22 |

Medical Expenses | $10,000,000 |

Repatriation | Included |

Baggage Delay/Loss/Theft | $2,500 |

Trip Cancellation | $7,000 |

Trip Interruption | $4,500 |

HEYMONDO ANNUAL MULTI-TRIP INSURANCE |

|

HeyMondo long-stay travel insurance

For those who are taking a longer-term trip (more than 90 days), I recommend HeyMondo’s long-stay insurance. You can purchase this plan whether you’re traveling for business, pleasure, or studies, and you’ll have coverage for medical expenses, repatriation, early return, and baggage, among other things.

This is the policy I purchased when I first came to live in the U.S. since I didn’t know if I was going to stay here permanently. That said, keep in mind that this insurance is only for people who are traveling, working, and studying abroad temporarily.

This Heymondo travel insurance is competitively priced but does have a deductible of $250. Plus, you can easily extend your coverage after the initial 3-month period as well as add optional coverage for things like adventure sports, electronics, cruises, and rental car excess.

You can learn more about this type of coverage and read a review of this HeyMondo travel insurance in our guide on the best long-term travel insurance.

Below, you can see the prices for long-stay HeyMondo insurance for a traveler who is going to spend 3 months abroad:

90 DAYS RENEWABLE | +30 DAYS | +120 DAYS | +180 DAYS | +275 DAYS |

|

|---|---|---|---|---|---|

Price | $244.54 | $76 | $328 | $503 | $731 |

Medical Expenses | $250 |

||||

Repatriation | $2,500,000 |

||||

Baggage Delay/Loss/Theft | Included |

||||

Trip Cancellation | $1,200 |

||||

Trip Interruption | $300 |

||||

HEYMONDO LONG-STAY INSURANCE |

|||||

What does HeyMondo cover?

Now that you know the different types of HeyMondo travel insurance, let’s dive deeper into what exactly they cover. This way, you’ll know what to expect from your policy in terms of medical- and travel-related benefits.

Emergency medical expenses

Depending on the plan, your country of residence, and your destination, HeyMondo has medical expense coverage ranging from $100,000 to $10,000,000.

Emergency medical expenses

This is one of the most important benefits of travel insurance, as it covers both medical and surgical expenses in the event of an accident or illness. For example, if you have to see a specialist, get emergency surgery or dental treatment, or you’re prescribed medication, you’ll be covered. However, be aware that HeyMondo doesn’t cover pre-existing conditions.

HeyMondo COVID coverage

Another advantage is that Heymondo insurance covers COVID just like any other illness, so if you have to receive treatment or be quarantined due to COVID-19, you’ll be covered. In fact, HeyMondo was one of the first companies to offer travel insurance with COVID coverage, so they set the bar for other providers.

Heymondo’s Covid insurance includes medical expenses due to a COVID-19 infection, including medically-prescribed PCR tests, medical transport and repatriation for affected return trips, lodging expenses due to medical quarantine, and trip cancellation caused by serious illness or death of you, your travel companion, or a family member due to COVID-19.

Of course, it’s important to go over your policy’s terms and conditions so you know exactly what’s covered.

Evacuation and repatriation

After reviewing HeyMondo’s travel insurance plans, you’ll see that they all include coverage for medical evacuation and repatriation.

Evacuation and repatriation

In the event of an accident or death during the trip, HeyMondo will be in charge of transporting you and/or your companion back to your country of origin. This coverage also applies if a family member was hospitalized or passed away during your trip and you had to return home.

This coverage includes up to $500,000 for medical repatriation and up to $100,000 for transport or repatriation of the deceased.

Trip cancellation and interruption

HeyMondo Top, HeyMondo Premium, and HeyMondo’s annual multi-trip plans include trip cancellation and interruption coverage. For flight delays over 4 hours, travelers have the right to have meals, lodging, and transportation expenses covered. The coverage limits vary depending on your policy but can be as high as $7,000.

It’s important to read through your policy’s benefits so you know which scenarios fall under the trip cancellation and interruption coverage. It’s also worth checking our guide on the best trip cancellation insurance. For example, certain situations aren’t covered by HeyMondo, such as canceling your trip due to fear of travel. That’s why I always recommend thoroughly reviewing your HeyMondo travel insurance before purchasing.

Some scenarios that are covered include sudden death, illness, or injury of yourself or a travel companion; a Travel Advisory warning at your destination that is issued after you’ve booked your trip; your home or business becoming uninhabitable; a jury duty summons; unexpected job termination; or police summons for robbery at your residence.

Baggage loss and theft coverage

Another benefit that I consider essential is baggage loss, damage, delay, or theft coverage. HeyMondo compensates travelers anywhere between $1,700 and $2,500 for stolen, delayed, damaged, or lost luggage. When I lost my bags on a trip, Heymondo’s customer service team helped me file a claim in the app, so I was quickly reimbursed for the toiletries I had to buy.

Baggage loss and theft coverage

Something to note is that this coverage doesn’t apply to electronics, as this is an optional add-on that you can tack on to your policy. And I recommend to do so!

Natural disaster insurance coverage

Phenomena such as avalanches, earthquakes, fires, floods, landslides, tornadoes, tsunamis, and volcanic activity are covered under Heymondo’s natural disaster benefit. This includes up to $1,250 for lodging and transportation during your trip dates.

HeyMondo’s optional coverage

Heymondo travel insurance also comes with the option to add more coverage to your policy for things like adventure sports and electronics. Since these are additions to your policy, they increase the total cost for your travel insurance plan.

Adventure sports coverage

If you plan to practice some risky activities or adventure sports during your trip, this type of coverage add-on is a good idea. Many activities are already included in HeyMondo’s Top and Premium plans, such as biking, canoeing, camping, kayaking, paddle surfing, helicopter rides, snorkeling, and surfing.

With the adventure sports add-on, you’ll be covered for even more extreme activities, including white-water rafting, canyoning, diving and underwater activities less than 65 feet deep, bouldering up to a height of 26 feet, horseback riding, climbing, fencing, caving at depths of less than 490 feet, water skiing, kitesurfing, mountain bike rides, quad biking, rafting, bungee jumping, and trekking at altitudes of up to 16,400 feet.

Add-on coverage for electronics

As I mentioned earlier, HeyMondo’s baggage coverage doesn’t apply to electronic equipment like laptops, tablets, and cameras. You can add electronic equipment coverage to your policy, which will slightly increase the total price.

Add-on coverage for electronics

The coverage amount for electronics ranges from 50% to 100% of the baggage coverage. So, if your photography gear, computer, or electronics are stolen, damaged by fire, or lost by the airline, you’ll be compensated for it. This type of coverage is super important for people like us who bring travel photography equipment along on trips!

Rental car excess

Depending on the type of coverage you purchase, you can add rental car excess to your policy. The excess is $500, so if your rental car is damaged or stolen, you’ll be covered for all repairs and expenses after paying the initial $500. This add-on is something to consider if you plan on getting a cheap rental car during your trip!

What’s not covered with HeyMondo?

While Heymondo travel insurance offers lots of coverage, there are a few things that aren’t included in your policy. I mentioned that pre-existing conditions aren’t covered (you can find the best travel insurance for pre-existing conditions in our guide), but there are some other things to keep in mind.

In a nutshell, the following scenarios aren’t covered by HeyMondo:

- Injury or loss caused by engagement in illegal activities or drugs

- Non-emergency medical expenses abroad

- Non-emergency dental expenses abroad

- Petty theft

- Pre-trip COVID-19 tests

- Zones of armed conflict

- Adventure activities including white-water rafting, diving, horseback riding, mountain biking, bungee jumping and climbing**

- Cruises**

- Electronic equipment including laptops, tablets, and cameras (limited coverage)**

**You can purchase additional coverage for adventure activities, cruises, and electronics.

Also, keep in mind that there are age limits for HeyMondo insurance. For trips up to 29 days, the age limit is 69, and for trips of 30 days or longer, the age limit is 49. In short, it’s important to double-check and review your HeyMondo travel insurance policy!

HeyMondo travel insurance pricing

To give you a better idea of the price for HeyMondo travel insurance, here is a comparison chart showing the different policies and costs. For this example, I compared the prices for a 7-day, 15-day, and 20-day trip to Mexico from Canada for one traveler. I did this for the single-trip, annual multi-trip, and long-stay insurance plans.

TYPE OF INSURANCE | MEDICAL COVERAGE | 7 DAYS | 15 DAYS | 20 DAYS |

|---|---|---|---|---|

HeyMondo Top | $5,000,000 | $28.11 | $68.38 | $73.05 |

HeyMondo Premium | $10,000,000 | $31.73 | $83.72 | $83.72 |

HeyMondo Medical | $10,000,000 | $25.69 | $62.50 | $63.14 |

Annual Multi-Trip (trips up to 90 days during 1 year) | $10,000,000 | $220.22 (trips up to 90 days during 1 year) |

||

Long-Stay (price for 3 months) | $2,500,000 | $244.54 (price for 3 renewable months) |

||

HEYMONDO TRAVEL INSURANCE PRICES |

||||

Remember, the price for your Heymondo insurance policy will depend on your country of residence, destination, and how much coverage you want. This chart is just to give you a better idea, and remember that you can get a 5% HeyMondo discount by purchasing your policy through our link.

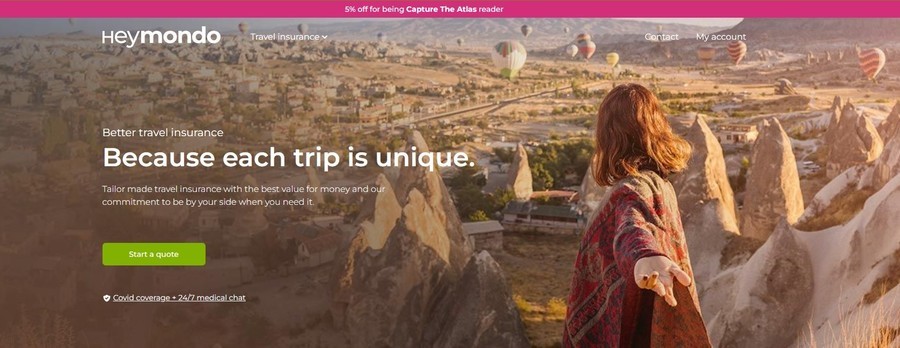

HeyMondo discount

If, after reading this Heymondo review, you want to purchase an insurance plan with the company, you can save money by going through this link. This way, you’ll get a 5% discount on HeyMondo just for being a Capture the Atlas reader.

HeyMondo discount

The discount doesn’t affect your coverage at all, so you’ll get the same great trip protection from Heymondo. Plus, on special dates like Spring Break and Black Friday, you can get 15% off Heymondo travel insurance, so you can save quite a bit.

How to purchase a HeyMondo policy with a discount

To get the HeyMondo discount, just click our link here. You’ll be redirected to the homepage, where you’ll see a banner at the top indicating the 5% discount code. Then, select the type of insurance you want, and enter some information about your travel dates, country of residence, and destination.

You’ll see that the discount is automatically applied, so just select the plan you want and proceed to checkout. The discount is valid on all types of Heymondo travel insurance, including single-trip, annual multi-trip, and long-stay insurance.

How does Heymondo customer service work if you get sick or get injured?

Hopefully, you’ll have an amazing trip and won’t need to contact HeyMondo’s customer service. However, accidents and illnesses happen, so if you suffer an injury or get sick, get in touch with Heymondo. Ideally, you should contact them before going to any hospital or medical center so that the HeyMondo support team can advise you on which place to go.

They can also contact the medical center directly and manage payment ahead of time. This way, you won’t have to worry about paying your medical bills, and you can instead focus on recovering and continuing your trip.

How does Heymondo customer service work?

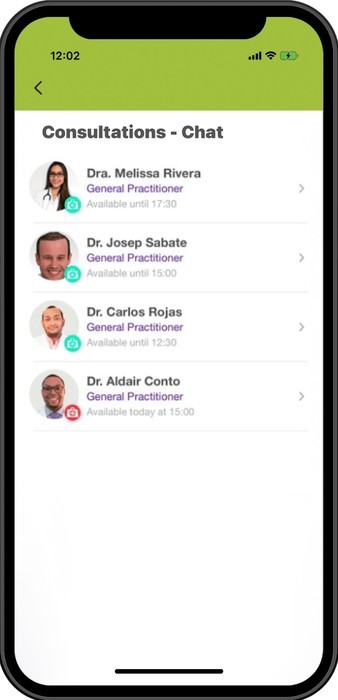

For emergency assistance, you can dial Heymondo’s contact number at +1 786 838 0757. Or, you can get in touch with them via the 24/7 app. Their team of doctors is always available, so it’s the easiest way to contact them.

If, for whatever reason, you aren’t able to get in touch with HeyMondo before going to the hospital, you’ll have to pay the bills yourself. Save all your invoices and medical reports so you can submit them and have Heymondo reimburse you!

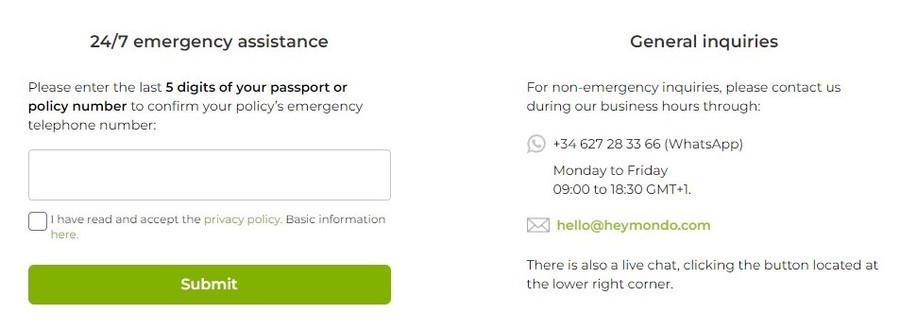

HeyMondo customer service and contact information

You can contact Heymondo customer service with any questions or concerns, be it advice on which medical center to go to, or for help with accessing your insurance documents. The support team is available at Heymondo.com, via email, by phone, and through the app.

On the company website, there is a help button at the bottom right. If you click it, you’ll be able to speak directly to a customer service agent and have any of your questions answered. Best of all, you can use this feature before, during, and after purchasing insurance.

For non-emergencies, you can email HeyMondo at hello@heymondo.com. Just keep in mind that you won’t get an immediate answer, although they usually respond within 24 hours. Another option is to call Heymondo’s contact number at 866 466 7891, and the team is available Monday – Friday from 7:00 a.m. to 10:00 p.m. (ET).

If it’s an emergency, you can go through this link and click “Contact” in the upper-right corner. Then, scroll down until you see “24/7 emergency assistance” and enter the last 5 digits of your passport or policy number, so you will get a Heymondo phone number to call for emergencies (it’s the same number that you will see in the app and policy, just in case you don’t have them handy).

HeyMondo customer service and contact information

You can also chat with Heymondo’s doctors through the HeyMondo app, which offers 24/7 communication. The app is available through Google Play on Android and the App Store for iPhone. The app allows you to see your Heymondo account and policy documents, manage incidents, and access the 24-hour medical chat.

You can also make free online assistance calls with doctors, although this is specifically for simple medical advice and non-emergencies. If you need immediate care, the HeyMondo team will refer you to a medical center or hospital. You can contact Heymondo through the app 24/7, even on holidays.

HeyMondo refunds and claims process and my experience

Making a claim and requesting a refund from Heymondo is super easy. Just use the app to contact Heymondo customer service 24/7. Ask to file a claim, upload your documents, and they’ll get back to you.

HeyMondo refunds and claims process

You have to provide some basic information like your name and policy number, and some additional documents may be necessary. For example, you should submit medical records and receipts if you want a reimbursement for your hospital bills, while a police report will help you file a theft claim.

Then, let HeyMondo process the paperwork for you. It shouldn’t take too long before they approve your request and ask for your payment details so they can refund you.

How long does it take to get a claim approved with Heymondo?

The Heymondo refund process is noticeably quicker than other travel insurance companies and typically takes just a couple of weeks as opposed to months of waiting around, but it depends on the claim and even the destination. Claims for incidents while traveling within the US usually require more time.

How to avoid issues when filing a claim with HeyMondo

To make the claims process as seamless as possible, have your policy number handy, as well as any supporting documents and evidence to back up your claim. This may include police reports, medical records, receipts, flight tickets, and photos of your belongings.

Also, review your Heymondo travel insurance so you know what’s covered and what’s not. For example, most pre-existing conditions aren’t covered, nor is missing a flight due to fear of travel. Moreover, HeyMondo covers theft losses by force, but not petty theft.

FAQs about HeyMondo travel insurance

To wrap up this Heymondo review, I want to share the answers to some common questions about Heymondo travel insurance:

That’s it for my HeyMondo review. This is everything you need to know about Heymondo travel insurance, so now you’re ready to get your policy and protect yourself for your next trip.

If you still have any questions, or you’d like to share your own HeyMondo travel insurance review, leave me a comment below. I’d love to hear from you!

Have a safe and enjoyable trip with Heymondo!

This company was super disappointing for me. Transavia airline moved my arrival airport from Amsterdam to Eindhoven, over 100km away, several weeks before my flight. HeyMondo wouldn’t cover the cost of my new ticket (<$500 total for a family of 4) because it wasn't weather or equipment related. This was massively disruptive to my trip, and I spent probably 20 hours working through the claims process with their provider to no avail. I won't be using Heymondo again and despite being a convenient tech-based option, would highly recommend that folks go through a more traditional travel insurance provider.

Hi Jeremy,

I’m sorry to hear about the inconvenience you experienced with your trip. Unfortunately, changes or cancellations made by airlines — such as moving your arrival airport — are not covered by travel insurance providers, including Heymondo.

In these cases, the best option is to contact the airline directly for a refund or rebooking, as all airlines offer full refunds or alternatives when significant changes are made to your itinerary. While travel insurance is great for many unexpected issues, airline-initiated changes fall under the airline’s responsibility.

Thank you again for your feedback, and I hope your future travels are smoother!

Ascen

Hi, I have a big question.

My couple and I planned to travel around Southeast Asia for a whole year, and we are looking an insure adequate to our plan.

So, what do you recommend more? The Heymondo Top/Premium or the long stay travel insure?

Hi Ale,

I recommend Heymondo’s long-stay travel insurance. You can extend your coverage after 3 months, and additional types of coverage are available (rental car insurance, electronics coverage, etc.)

Best,

Ascen

Are their age restrictions for the insurance ie.over 70. Also how do they deal with pre-existing conditions?

Hi Paul, I recommend checking our article on the best travel insurance for pre-existing conditions.

Heymondo is one of the best travel insurance companies in the market but if you have some pre-existing conditions, maybe it is not the best option for you.

Let me know if you have any questions,

Ascen

I live in the USA and wanted to find out if HeyMondo also works for traveling within the USA. I understand that my regular health insurance covers medical emergency, but how about Travel Cancellation, Trip Delay/Interruption, Baggage? Tks

Yes, it covers if you’re traveling out of your state. Last year they cover me in Alaska (I had to used it) and in Hawaii (living in PA).

Ascen

Heymondo uses AXA for the quote I was looking at and it sounds too good to be true for my trip to cost $300USD vs majority is over 800. I did some research and saw that AXA has some really bad reputation. Has anyone have great experience with them in cases where they were needing to claim some serious medical emergencies?

Hi Lyna,

I have been using Heymondo/AXA for more than three years and I have had some medical emergencies and not an issue yet. Besides, you don’t need to fill any claim and wait for being reimbursed. Heymondo pays all the medical expenses in front, so I haven’t had to deal with any medical bills or out-of-pocket expenses yet.

Let me know if this help,

Ascen