Choosing the right travel insurance for the United States can be a bit tricky. After all, it depends on several factors like your age, the purpose of your trip, and how long you’ll be visiting the U.S. You can even find policies for U.S. citizens who are living abroad and coming back to the States for a visit.

However, if you’re looking for insurance for U.S. residents traveling within the country or coverage for Americans traveling abroad, you should read our guides on domestic travel insurance and travel insurance for Americans.

Best Travel Insurance for the USA in 2025

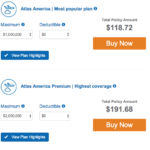

When it comes to the best travel insurance for parents visiting the USA, those studying abroad in the United States, individuals coming here for work, and tourists, there are a few great options. I’ll tell you upfront that Heymondo is the overall best holiday insurance for the USA. It offers single-trip and multi-trip insurance plans, making it a great option for all kinds of travelers.

Plus, Heymondo is the only tourist health insurance in the USA that pays your medical expenses upfront instead of having you pay out-of-pocket and file a claim to get reimbursed. This is imperative in a country like the United States, where healthcare is incredibly costly. If you decide to go with Heymondo, click our link below to get a discount on Heymondo insurance.

Of course, there are other good USA travel insurances on the market. SafetyWing is the second-best choice and a cheaper alternative to Heymondo. I’ll cover these companies and more in this guide, including what your policy should cover, so keep reading.

Best insurance for travel to the U.S. in 2025

If there’s a country where having travel insurance is essential, it’s the United States. However, finding the best travel insurance for the USA isn’t always straightforward since it depends on the reason for your trip. Maybe you’re only visiting for a few weeks, or perhaps you’ve come here to work or study abroad. Don’t worry because this guide will help you choose the perfect coverage plan for your needs.

In a nutshell, these are the 4 best U.S. travel insurance companies:

- Heymondo, the best travel insurance for the USA

- SafetyWing, a cheap travel insurance to the USA

- IMG Global, another good travel insurance for visitors to the USA

- Trawick International, the best U.S. travel insurance for students

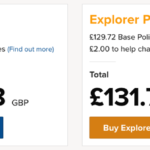

Cost of travel health insurance for the USA

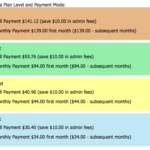

Before we delve into the best travel insurance companies for the U.S., here is a pricing chart to help you quickly compare each option. Remember, the cost of travel health insurance for the USA depends on various factors like the duration of your trip, your age, how much coverage you want, and whether you’re purchasing medical-only insurance.

For this USA travel insurance comparison, I used the example of a 30-year-old British citizen visiting the U.S. for two weeks, with a trip cost of $2,500:

Price | $70.59 | $41.72 | $56.53 | $56 |

Deductible | $0 | $250 | $0 | $0 |

Medical Expenses Paid Upfront | Yes | No | No | No |

Emergency Medical Expenses | $5,000,000 | $250,000 | $500,000 | $500,000 |

Evacuation & Repatriation | $500,000 | $100,000 | $1,000,000 | $2,000,000 |

Trip Cancellation | $3,500 | Not covered | 100% of $2,500* | Not covered |

Trip Interruption | $1,000 | $5,000 | 100% of $2,500* | $5,000 |

Baggage Loss | $1,700 | $3,000 | $500 | $1,000 |

BEST TRAVEL INSURANCE FOR THE USA |

||||

While SafetyWing is the cheapest USA travel insurance, it has a $250 deductible and limited travel-related benefits.

Heymondo costs a bit more than IMG Global and Trawick International, but it offers excellent medical expense coverage, which is super important for the USA. Also, it’s the only American travel insurance that pays your medical bills upfront, so you don’t have to pay out-of-pocket and file a claim for reimbursement.

For us, it’s worth spending a bit more for a much higher amount of coverage, but you can decide for yourself after reading about each of these companies below.

1. Heymondo, the best travel insurance for the USA

Whether you’re taking a short vacation, studying abroad for a few months, or starting a new job here, Heymondo is the best travel insurance for visitors to the USA.

There are several reasons why Heymondo travel insurance is one of the best options on the market. First of all, they have a variety of plans, including single-trip insurance, annual multi-trip insurance, and medical-only travel insurance.

Not only that, but Heymondo is the only travel insurance company that pays your medical expenses upfront instead of making you pay for it yourself and then file a claim for reimbursement. This is especially important in the United States, where healthcare expenses are through the roof.

Another advantage of Heymondo is its excellent price-to-coverage ratio. Whenever we’ve compared U.S. travel insurance, Heymondo has always come out on top for offering competitive prices while matching or even exceeding similar insurances’ coverage.

| PROS | CONS |

|

|

We’ve had a great experience using Heymondo on all our most recent trips. Not having to deal with the hassle of paying out-of-pocket for accidents and injuries has been amazing, and the 24/7 customer support app has been wonderful in helping us stay informed and calm in emergencies. Our family always buys Heymondo’s medical insurance for USA visitors whenever they come to see us, and they love it, too.

This is easily one of the best travel insurance companies of 2025, so if you want to purchase a policy, use our link below to get a discount on Heymondo.

2. SafetyWing, a cheap travel insurance to the USA

If you’re on a budget, SafetyWing is the best choice for cheap travel insurance to the USA. It offers a good amount of medical-related coverage, which is crucial in a country like the United States, where even a simple doctor’s visit can be expensive.

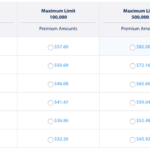

Whether you’re traveling for pleasure, work, or studying, SafetyWing is one of the overall best medical-only travel insurance options. Its plans are specifically tailored for travelers who want comprehensive medical coverage (hospital stays, ambulance transportation, emergency dental service, etc.) Plus, there is the option to automatically renew your plan every month until you choose an end date, so you never have to travel without coverage.

While this is one of the best tourist health insurances for the USA, it doesn’t have as many travel-related benefits. It also has a $250 deductible, so you’ll be responsible for paying that amount yourself before medical benefits kick in.

As an alternative, Heymondo has medical-only travel insurance for USA visitors, as well as comprehensive plans for health- and travel-related coverage. Moreover, there is a $0 deductible with Heymondo, and the company pays your medical bills upfront, so you don’t have to file a claim and wait for reimbursement.

| PROS | CONS |

|

|

3. IMG Global, another good travel insurance for visitors to the USA

IMG Global is another USA visitors travel insurance worth looking into. This company has a wide range of plans to appeal to different types of travelers. For example, you can find a policy if you’re a U.S. expat coming back to the States for a visit, a foreign exchange student in the U.S., a parent visiting your child in the USA, a remote worker, or a tourist.

Patriot America Plus is one of IMG Global’s policies and a good choice for those looking for one of the best comprehensive USA travel insurance plans. It includes a high amount of emergency medical expense coverage, as well as accidental death, evacuation, natural disaster coverage, and lost luggage protection. There is even coverage for the acute onset of pre-existing conditions for travelers under age 70.

The Patriot Exchange Program is a USA health insurance for international students, particularly those who meet the US J1 and J2 visa requirements. This plan covers many medical expenses, including hospital room and board, physician visits, prescriptions, urgent care, emergency room visits, and more.

It’s also worth noting that IMG Global is known as one of the best trip cancellation insurance companies, and it has excellent Cancel-For-Any-Reason insurance. I recommend getting a quote since prices vary depending on your choice of deductible and how much maximum coverage you want.

| PROS | CONS |

|

|

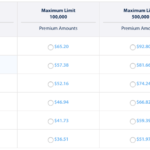

4. Trawick International, another great holiday insurance for the USA

Speaking of studying in the U.S., Trawick International is another one of the best international travel insurances for students.

For example, the International Student and Scholar Medical Evacuation and Repatriation plan is designed for students who want to save money and just have coverage for emergency evacuation to their home country.

There is also the Collegiate Care plans, which include the Essential, Enhanced, Elite, and Exclusive tiers. They range in terms of maximum coverage limits and deductibles, but they all offer health-related benefits like emergency medical expense coverage, accidental death, and evacuation. You can also choose your deductible ($0, $100, $250, $500, $1,500).

Another one of Trawick International’s American health insurances for visitors is the Safe Travels Voyager plan. It includes your choice of deductible, $500,000 in emergency medical expense coverage, $2,000,000 for evacuation and repatriation, $5,000 for trip interruption, and a $1,000 baggage loss benefit. However, this policy doesn’t include trip cancellation coverage.

A company that does include trip cancellation benefits is Heymondo. Its long-term travel insurance is suitable for students on a budget as well as remote workers, American expats, and tourists. For just a bit more money, you can get a higher amount of coverage with no deductible and no need to pay anything out of pocket since Heymondo pays your medical bills upfront.

| PROS | CONS |

|

|

Is travel insurance for the United States mandatory?

Having travel insurance isn’t a requirement for entering the United States, but it’s a very good idea to get a USA travel insurance policy.

If you’re worried about the cost of USA travel health insurance, consider that American healthcare is super expensive. An insurance policy pretty much pays for itself after just one trip to the doctor or urgent care center. It’s much better to pay upfront for USA tourist travel insurance than shell out hundreds or even thousands of dollars for medical attention.

To give you a better idea of the average cost of medical care in the U.S., here is a chart with some of the most common services:

MEDICAL SERVICE | COST |

|---|---|

Price of a medical visit without tests | $450 |

Price of an emergency room visit | $3,300 |

Price of an x-ray | $550 |

Price of an MRI scan | $1,150 |

Price of a CAT scan | $3,270 |

Price of an appendicitis operation | $11,600 |

Price of a night in hospital | $5,220 |

Price of general anesthesia | $8,800 |

Price of ambulance transport | $1,700 |

Price of an emergency room stay | $2,300 |

AVERAGE COST FOR MEDICAL SERVICES IN THE USA IN 2025 |

|

The average cost for an urgent care visit in the United States without insurance is $175. That’s more than twice the amount of the USA visitors medical insurance plans in this article. I’d say it’s definitely worth investing in a policy!

Even if you’re on a strict budget, there are plenty of cheap travel insurance options that can give you the protection you need without breaking the bank.

What should U.S. travel insurance cover?

Before you buy travel insurance for the USA, it’s important to know what your policy should include. Below, you’ll find the must-have coverage you should look for when comparing USA travel insurance:

Emergency medical expense coverage

First, emergency medical expense coverage is crucial, especially considering the steep price of U.S. healthcare and services. Don’t risk paying out of pocket for a trip to an urgent care center or hospital! With this benefit, you’ll be covered for those doctor visits, as well as tests and treatments, depending on the policy terms.

Emergency medical expense coverage

Evacuation and repatriation

This type of coverage is important if you need to return to your home country for treatment after falling seriously ill. All the best travel medical insurance for USA visitors includes this benefit.

Trip cancellation, interruption, and delays

Whether it’s a cancelled flight or an illness that disrupts your trip, this type of benefit will make sure you’re covered. If you want this type of coverage, make sure you get a USA travel insurance policy with travel-related benefits, not just medical.

Trip cancellation, interruption, and delays

Baggage loss, theft, or damage

Replacing clothes and toiletries can get expensive, so a policy with baggage loss coverage can help you replace your precious items without shelling out your own money.

FAQs – Travel insurance for the United States

Finally, here are some common questions about travel insurance for the USA:

In conclusion, having travel insurance for a trip to the USA is always a good idea. Plus, there are USA holiday insurance plans for any kind of trip, traveler, and budget.

We consider Heymondo to be the overall best insurance for travel to the USA. With its affordable prices and extensive coverage, it’s a great value for money. It’s also the only insurance that pays your medical expenses upfront, so you don’t have to cover the cost of ridiculously priced healthcare and then file a claim for reimbursement.

If you decide to go with Heymondo, don’t forget to take advantage of our Heymondo discount code below.

Of course, don’t hesitate to leave me a comment below if you have any other questions about travel insurance for visitors to the USA. I’d be happy to help you out!

Stay safe, and have a great trip to the States!

do you have tourist health assurance for visitors over 70 years old ?

Hi Rochard,

I recommend IMG Global because they have senior-specific plans. You can also read our guide to the best travel insurance for seniors to see more great options. Good luck!

Ascen

Any ideas for Death Valley and Alabama Hills photo tour?

What are your suggestions for a Yosemite trip?

Thank you,

Renate

Hi Renate,

Our Death Valley & Alabama Hills photo tour is actually going on now! But you can sign up for next year 🙂

We also have an awesome guide on things to do in Yosemite, so I suggest checking it out!