When traveling abroad, get a policy from one of the best travel insurance companies. You can get a 5% discount on Heymondo, the only insurance that pays all medical bills upfront for you, HERE!

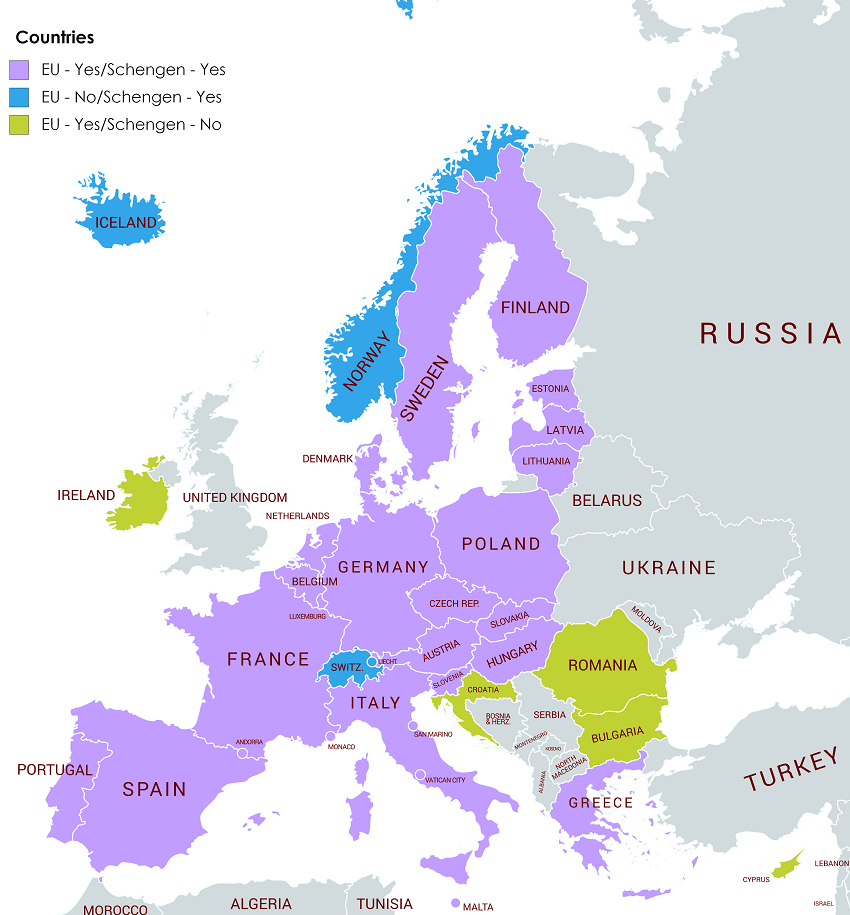

Getting European travel insurance is one of the main requirements for obtaining a Schengen visa, whether for traveling, studying, or working overseas.

However, if you don’t need a Schengen Visa, you may ask yourself, Do I need travel insurance for Europe? Well, it’s always a good idea. As I mentioned in my guide to the best international travel insurance companies, you should buy coverage if you want the peace of mind that comes with knowing you’re protected in any unforeseen circumstances.

4 Best travel insurance for Europe in 2026

Of course, not everyone needs the same kind of coverage, so in this article, I’m sharing the best travel insurance for Europe and Schengen travel insurance that meets all the visa requirements:

- Schengen visa travel insurance requirements

- Europe travel insurance cost & comparison

- Best travel insurance for Europe

- What should European travel insurance cover?

Not to spoil the surprise, but Heymondo is the best option for Europe trip insurance and Schengen Area travel insurance. Heymondo offers comprehensive coverage at an affordable price, and it’s the only company that pays your medical expenses upfront, so you don’t have to worry about filing a reimbursement claim.

Another great option, if you’re traveling on a budget and don’t mind having a deductible, is SafetyWing. Just be aware that there is a $250 deductible per claim, and they don’t cover medical expenses upfront. You will need to pay out of your pocket and ask for reimbursement later, but it is the cheapest option by far.

I’ll give you a full review of other top travel insurance for Europe below.

Is travel insurance for Europe mandatory?

If you’re required to have a visa to enter the Schengen Area, you must have travel medical insurance for a Europe trip. Be aware that not all travelers need a Schengen visa, so check the requirements for different countries below.

If you’re a citizen of a country in the Schengen Area, you don’t need travel insurance for Europe, but it’s wise to have coverage for your trip.

How much does European travel insurance cost?

Choosing the best travel health insurance for Europe is one of the most frequent doubts among tourists. We currently have a policy with Heymondo, and we’re very happy with it. The company has been super responsive and helpful whenever we’ve needed assistance. I love that they take care of medical payments for us upfront, so we don’t need to pay out of pocket and file a claim.

If you’re still unsure which European tourist insurance best suits you and your needs, look at the table below. I’ve compared the cost of European travel insurance from 4 different companies. To be as impartial as possible, I’ve simulated the prices for a 30-year-old American traveling to Spain for two weeks with a trip cost of $2,500.

Price | $89.05 | $22.54 | $75.02 | $97.00 |

Medical Expenses Paid Upfront | ✔️ | ❌ | ❌ | ❌ |

Deductible | $0 | $250 | $0 | $0 |

Coverage in Schengen Area | ✔️ | ✔️ | ✔️ | ✔️ |

Emergency Medical Coverage | $200,000 | $250,000 | $50,000 | $50,000 |

Evacuation & Repatriation | $500,000 | $100,000 | $200,000 | $500,000 |

Natural Disaster Evacuation | $50,000 | N/A | $30,000 | $75,000 |

Trip Cancellation | $10,000 | N/A | 100% of $2,500* | 100% of $2,500* |

Trip Interruption | $10,000 | $5,000 | 100% of $2,500* | 150% of $2,500* |

Trip Delay | $3,000 | $200 | $1,000 | $2,000 |

Baggage Loss | $3,000 | $3,000 | $750 | $1,000 |

Electronic equipment | $1,500 | N/A | N/A | $500 |

BEST TRAVEL INSURANCE FOR EUROPE |

||||

*Price used for example

For this European travel insurance comparison, I chose the cheapest policies that cover the Schengen Area and meet all the requirements. While Heymondo isn’t the cheapest, it offers better coverage than the others, and it’s the only one that pays for medical expenses upfront.

Also, remember that these prices are just an example and can vary depending on your trip’s duration, your country of origin, destination, and other factors. However, no matter the cost, you want travel insurance, even for the cheapest places to visit in Europe.

Best Europe travel insurance

Again, each European travel insurance company has its advantages, so I’m sharing an overview of each option below to help you make the best choice.

1. Heymondo, the best travel insurance for Europe

Heymondo is the best holiday insurance for Europe, offering $200,000 in emergency medical coverage and no deductible. One of the main advantages of Heymondo insurance is the 24/7 customer support and medical chat. This way, you can quickly consult a doctor or get directions to the nearest hospital.

Another thing I like about Heymondo is that it takes care of everything, so you won’t have to pay a single bill out of pocket. No more filing claims and waiting for reimbursement! Just remember that for Heymondo to cover expenses upfront, you must contact them before going to the doctor. If you forget or don’t have time, don’t worry. Heymondo will refund your money after you send them the medical invoice.

Besides, it covers electronic equipment, something that most travel insurance doesn’t include. For us, that coverage is crucial since we always travel with two laptops and professional camera gear.

| PROS | CONS |

|

|

We’ve been using Heymondo’s annual travel insurance and have been delighted with the experience. We have had to use the customer support more than once, and the team has always been professional, efficient, and kind. If you choose this company for your European travel health insurance, you can save 5% with our Heymondo discount.

2. SafetyWing, a cheap European travel insurance

If you’re looking for a low-cost Schengen travel insurance policy, look into SafetyWing. It’s one of the cheapest travel insurance companies on the market, offering excellent coverage without a hefty price.

SafetyWing’s European travel health insurance includes extensive emergency medical coverage, evacuation and repatriation protection, and up to $5,000 in trip interruption benefits for added peace of mind.

However, while SafetyWing has some of the lowest prices on the market, remember that it’s more of a medical travel insurance, so its trip-related coverage is minimal.

Also, there is a $250 deductible, so you’ll have to pay $250 before the company covers your medical costs. If you don’t want to deal with a deductible and want the added benefit of having your expenses paid upfront, I recommend Heymondo.

| PROS | CONS |

|

|

3. Trawick International, the best Europe travel insurance for seniors

Trawick International is another option to consider, especially if you’re looking for a good travel insurance plan for seniors. Trawick is affordable and features great medical benefits, including coverage for pre-existing conditions. The company also offers decent protection for natural disasters and repatriation.

This company also has travel insurance with Cancel For Any Reason (CFAR). So, if you add CFAR to your policy, you’ll get reimbursed for your flight and accommodation expenses if you call the trip off, regardless of the reason for your cancellation. However, there are specific terms and conditions, so I recommend reading the policy thoroughly.

It’s important to review the different Trawick policies since some pertain to European travel insurance while others are tailored to students or tourists coming to the USA. In our comparison, we looked at the Safe Travels Explorer plan, which includes decent trip cancellation and interruption coverage, but only a small amount of baggage loss protection.

Overall, you can get much more coverage for the same price or a bit more. For example, Heymondo offers $200,000 in emergency medical expenses compared to Trawick’s $50,000. Plus, Heymondo pays your medical expenses upfront.

| PROS | CONS |

|

|

4. Travelex, another good travel health insurance for Europe

Lastly, Travelex is dependable tourist insurance for Europe that meets all Schengen visa insurance requirements. Its Select plan is the more expensive option, but it includes extensive repatriation and evacuation coverage, as well as natural disaster protection.

You’ll also be covered for travel-related expenses like baggage loss/theft, trip cancellation/interruption, and trip delay. Travelex is also a travel insurance that covers pre-existing conditions, making it a good choice if you want your policy to cover treatments and medication abroad for chronic diseases like diabetes.

On the other hand, the Select plan is the most expensive option of the policies we looked at, and the emergency medical expense coverage is very low. In comparison, Heymondo offers much better coverage for a lower price.

| PROS | CONS |

|

What should travel insurance for Europe cover?

When shopping around for travel medical insurance for Europe, make sure you’re looking for the best coverage. Below, you can see what the best European travel insurance should include:

Emergency medical expenses

Emergency medical coverage is the most basic and essential requirement for any European holiday insurance. Even the cheapest policies include this type of coverage. With emergency medical expenses protection, you’ll be covered for any visits, tests, treatments, and hospitalizations during the trip due to illness or injury.

However, chronic illnesses or sicknesses that existed before the start of the trip are excluded from this coverage. For example, the insurance won’t cover treatment for cancer, as that’s a chronic disease that must be treated in your country of origin. On the other hand, an emergency operation for appendicitis would be covered.

Emergency medical expenses, something that’s covered with European travel insurance

As for injuries and accidents, most policies don’t cover incidents that occur while practicing extreme sports or risky activities. In the case of Heymondo, some adventure sports are included in the Premium plan. For other insurers, there is the option to add this type of coverage to your policy for an extra fee. So, if you’re a daredevil and plan on participating in some extreme sports during your trip, I recommend getting a policy with Heymondo.

Evacuation & repatriation

Evacuation and repatriation coverage are other must-haves when buying insurance for a European trip. If you have to return to your home country due to a medical emergency or death abroad, this coverage will take care of the associated expenses. Moreover, if a family member back home gets seriously sick or dies, or there is an accident at your home, the costs will fall under this category.

Trip delay

Unexpected delays can happen while traveling, be it a flight delay, weather problems, or an issue with the airline. This is why many European travel insurance companies include trip delay coverage. This covers expenses like meals and accommodation if your trip is delayed several hours or more.

Trip cancellation & interruption

As for trip cancellation, it’s often not included in European travel insurance. You usually must take out a trip cancellation policy or add this coverage to your plan.

With trip cancellation protection, you’ll be covered if you have to cancel your trip for health, legal, or work reasons. The amount varies depending on your policy, but you could recover up to 100% of the money you invested in the trip. Of course, you must provide documentation justifying the cancellation.

Trip cancellation & interruption

If you want the option of canceling your trip for any reason and getting reimbursed, look into Cancel For Any Reason (CFAR) insurance. Many companies offer this coverage as an add-on.

Moreover, trip cancellation coverage is especially useful if you’re visiting multiple countries in Europe. An unexpected incident may come up in the middle of your trip, such as a family member getting sick or a natural disaster back home. Instead of losing all the money you paid for the rest of your journey, you can get reimbursed with European travel insurance with trip cancellation/interruption benefits.

Baggage loss, theft, or damage

It’s not uncommon for luggage to get lost, stolen, or damaged during travel. For this reason, I consider this type of coverage essential for any European travel insurance plan.

Be sure to check the monetary amount for this benefit since some insurers don’t offer as much protection as others. I also suggest keeping your most valuable and expensive items with you in a backpack or carry-on so you don’t risk losing them in your checked baggage.

If you can’t store your things in a hotel, consider using a luggage storage service once you’ve arrived at your destination. This way, you’re not a walking target for pickpockets!

Electronic equipment

If you’re bringing electronic equipment like a camera or laptop, be aware that these items aren’t typically covered under the baggage loss benefit. An exception is Heymondo, which includes electronic equipment protection in its policies.

For most other European travel insurance plans, you’ll have to get this coverage as an add-on for an extra fee.

Adventure sports

This is another benefit that’s often available as an add-on. If you know you’ll be participating in some extreme activities, adding this type of coverage to your policy is a good idea. Adventure sports include things like bungee jumping, skydiving, scuba diving, and white-water rafting.

Heymondo is one of the few European travel insurance companies that include adventure sports protection in its policies.

Search and rescue

Another insurance benefit is search and rescue coverage. This covers the cost of an organized search and rescue effort should you get lost or reported missing during your trip.

Natural disaster evacuation

Finally, natural disaster coverage will pay for the transportation costs if you need to return to your home country due to a natural disaster at your destination. Examples of natural disasters include earthquakes, floods, landslides, tornadoes, tsunamis, volcanic eruptions, and wildfires.

Europe travel insurance with a discount

If you decide to get travel insurance for a Europe trip, remember that you can take advantage of our discount to save money on your policy.

Europe travel insurance with a discount

In the case of Heymondo, you can get a cheaper European travel insurance policy for being a Capture the Atlas reader. Just click our link below to get a 5% discount on Heymondo insurance.

Also, be sure to read our guide on the best discounts for travel so you can save money on flights, hotels, rental cars, and more.

Is Europe travel insurance worth it?

Even if you aren’t required to get a Schengen visa (and thus European travel insurance), getting coverage is still a good idea. We never travel without insurance, and I advise everyone to do the same. After all, you never know what could happen abroad, whether you get in an accident or fall ill.

Throughout the years, my friends and I have had many experiences that highlight the importance of having insurance.

For example, I was studying English in Ireland with my cousin when he had to have emergency surgery for appendicitis. Luckily, he had EU travel insurance, so the cost of his operation was covered. He would have been stuck paying thousands if he hadn’t had travel medical insurance for Europe.

Another time, I was taking a trip to Germany, and my luggage never arrived. I was stressed out about not having any clothes or toiletries, but fortunately, I had travel insurance, so the company covered the cost of all the clothes and necessities I had to repurchase.

Is Europe travel insurance worth it?

While those two scenarios ended nicely, my family and I have had less-than-ideal situations that resulted from not having insurance coverage.

One of those was when I planned a trip to Ukraine years ago. I had to cancel it because of a family emergency, and since I didn’t have travel insurance for Europe, I lost all the money I had invested in flights and hotels.

Similarly, my mom didn’t bother to get insurance before traveling to London. Someone stole her bag in a pub, so she lost her cell phone, camera, and wallet (with her ID and credit cards). She could’ve been covered for these losses if she had purchased European holiday insurance. Unfortunately, she had to pay to replace everything herself.

As you can see from the examples above, all kinds of unexpected circumstances crop up while traveling. It’s always better to have the added security of trip insurance. Take it from me, and don’t learn your lesson the hard way!

Other things to plan for your trip to Europe

Once you get the best travel medical insurance for Europe, finish organizing your trip with these helpful tips:

- Get one of the best SIM cards for Europe to avoid paying for roaming while using internet in Europe. We always use the Holafly eSIM, and you can even purchase it if you’re already abroad.

- Get a travel credit card to avoid hefty fees when using foreign ATMs. There are even some great credit cards with no foreign transaction fees that you can take advantage of.

- Check the iVisa website to see if you need a Schengen visa for your trip. If you do, make sure you request it in advance so you have it in time for your trip.

Lastly, enjoy your trip to the fullest!

FAQs – Travel insurance for Europe

If you still have concerns about European trip insurance, these answers to commonly asked questions may help:

I hope this guide helps you find the best travel health insurance for Europe and that you feel better prepared for your trip. Remember, if you need a Schengen visa to enter the Schengen Area, you’ll need proof of insurance to get the visa.

However, even if you don’t need a Schengen visa, it’s still worth getting European travel insurance. It’s always safer to travel with insurance coverage. This way, you can enjoy your trip and have peace of mind knowing you won’t have to pay any medical bills and cancellation fees out of your own pocket.

Again, Heymondo is the best European holiday insurance, offering excellent coverage for a reasonable price and direct, upfront payments for medical expenses. If you decide to buy a policy, take advantage of our 5% Heymondo discount code below.

Stay safe, and have a wonderful time in Europe!

Is there a Schengen insurance that covers the UK on the same trip?

Hi Supinda,

Yes, with the companies above, you can find European travel insurance plans that cover Schengen countries and the UK.

I wish to travel multiple trips to Europe

4-5 days duration

4-5 trips per year

Mostly with my kids

Then I recommend you annual multi-trip travel insurance instead.

Let me know if you have any questions,

Ascen

We are a family of four and applying for long term resident visa for Spain. We need health insurance for the visa. What do you recommend?

Hi Mirza,

How long are you planning to stay in Spain. I usually recommend Heymondo, but if you’re staying for long, maybe it’s better to get a health insurance instead of a Travel Insurance,

Thanks,

Ascen

Great information. Thank you so much for the information. Amazing services are there. i am very glad to see this blog. in the Schengen visa Itinerary also, providing good services like Flight Itinerary, Hotel Reservation and Travel Insurance are there.

Thank you!

hi

Nigeria passport holder want to attend 15 days course in amsterdam Netherland base in Dubai UAE which travel insurance do you recommend for me thanks

Hi Sikiru,

I would try this one.

Let me know what you think.

Ascen

Hi,

We are a family of five traveling to Italy from the US. We are planning to do some hikes there. Which insurance do you recommend?

If you are going to have any kind of hiking or adventure sport I would go with insuremytrip standard for sure. It is the best insurance for Europe if you plan up to 2000m.

Ascen

Thanks for this great post! I found all the info I need to decide which is the best travel insurance for my trip to Europe. I hope don’t have to use it though

Hi Malene,

I am glad to read you! Let me know if you have any question and safe travels!

Ascen